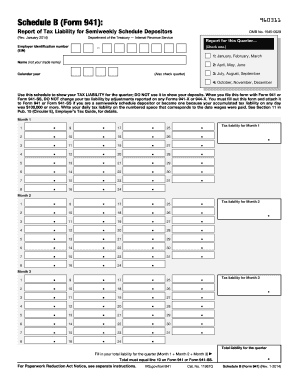

Get Irs 941 - Schedule B 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 941 - Schedule B online

How to fill out and sign IRS 941 - Schedule B online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

If individuals aren’t associated with document management and legal processes, completing IRS forms can be rather daunting.

We understand the significance of accurately filling out paperwork.

Leveraging our platform can undoubtedly transform proficiently filling IRS 941 - Schedule B into a reality. Ensure everything is set up for your convenience and seamless workflow.

- Click on the button Get Form to access it and start editing.

- Complete all required fields in the document using our robust and user-friendly PDF editor. Activate the Wizard Tool to make the process even simpler.

- Confirm the accuracy of the information provided.

- Include the date of completing IRS 941 - Schedule B. Utilize the Sign Tool to establish your signature for the document certification.

- Finish editing by clicking on Done.

- Send this document to the IRS in the most convenient manner: via email, with digital fax, or traditional mail.

- You can also print it out if a physical copy is needed and store or save it to your preferred cloud service.

How to modify Get IRS 941 - Schedule B 2011: personalize forms online

Streamline your document preparation workflow and tailor it to your needs with just a few clicks. Finalize and authorize Get IRS 941 - Schedule B 2011 with an all-encompassing yet intuitive online editor.

Handling documents can be a hassle, particularly when you do it sporadically. It requires strict compliance with all regulations and accurate completion of every section with precise data. However, it frequently happens that you need to modify the document or add additional sections to complete. If you wish to enhance Get IRS 941 - Schedule B 2011 before submitting it, the most efficient way to achieve this is by utilizing our powerful yet user-friendly online editing tools.

This extensive PDF editing solution allows you to swiftly and effortlessly fill out legal documents from any device connected to the internet, make fundamental modifications to the template, and incorporate more fillable fields. The service allows you to select a specific section for each data type, such as Name, Signature, Currency, and SSN, among others. You can designate them as mandatory or conditional and determine who should complete each field by assigning them to a specific recipient.

Our editor is a versatile multi-functional online solution that can assist you in easily and quickly adjusting Get IRS 941 - Schedule B 2011 along with other forms to meet your specifications. Reduce document preparation and submission time and ensure your paperwork appears flawless without any hassle.

- Access the necessary file from the library.

- Complete the fields with Text and place Check and Cross tools in the tickboxes.

- Use the right-hand panel to modify the form with new fillable fields.

- Select the sections based on the type of data you want to collect.

- Set these fields as required, optional, and conditional, and arrange their order.

- Assign each section to a particular party using the Add Signer tool.

- Verify that all necessary changes have been made and click Done.

Get form

Related links form

A Schedule B for 941 is a supplementary form that reports your tax payment schedule for specific payroll tax liabilities. It is essential for employers who have substantial tax responsibilities and ensures that the IRS has accurate timing information for tax deposits. Complete and accurate filing of this form simplifies compliance and helps prevent penalties.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.