Loading

Get Irs 940 - Schedule R 2014

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 940 - Schedule R online

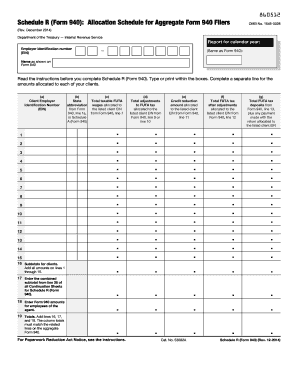

This guide provides a detailed explanation of how to complete IRS 940 - Schedule R online. By following these steps, users can ensure accurate reporting of unemployment tax allocations for their clients.

Follow the steps to fill out Schedule R correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your business information. Carefully input your employer identification number (EIN) and your business name at the top of the Schedule. Ensure that this information exactly matches that on Form 940.

- Fill in the calendar year for which you are filing your Form 940. Confirm that the year entered matches the year on the attached Form 940.

- Report the necessary information for each client on Schedule R. This includes: the client’s EIN, the state abbreviation of the client's location, total taxable FUTA wages allocated, total adjustments to FUTA tax, credit reduction amounts, total FUTA tax after adjustments, and total FUTA tax deposits from Form 940.

- If applicable, for each employee, report the same information on Schedule R, line 18.

- Add the totals from lines 16, 17, and 18 to compute the overall totals on line 19. Ensure the totals match the related amounts reported on Form 940.

- Review all entries for accuracy. If the totals on Schedule R do not match those on Form 940, correct any inaccuracies before submission.

- Once completed, users can save changes, download, print, or share the completed form as needed.

Prepare and submit your Schedule R online to ensure accurate filing and compliance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The regular 1040 form is designed for all taxpayers, while the 1040SR is tailored for seniors aged 65 and older. The 1040SR features larger text and a clearer layout, enhancing usability for older individuals. Depending on your age and preferences, selecting the appropriate form can streamline your tax filing, including any necessary references to IRS 940 - Schedule R.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.