Loading

Get Irs 8959 2016

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8959 online

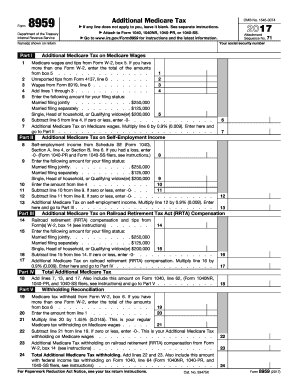

The IRS Form 8959 is used to calculate the Additional Medicare Tax, applicable to high-income earners. This guide will provide you with a step-by-step approach to completing the form online, ensuring a smooth filing process.

Follow the steps to complete the IRS Form 8959 online:

- Press the ‘Get Form’ button to access the form and open it in your editor.

- Enter your name as it appears on your tax return in the designated field.

- In Part I, provide any unreported tips from Form 4137 in line 1, followed by wages from Form 8919 in line 2.

- Add the amounts from lines 1 through 3 and enter the total in line 3.

- For line 4, select the appropriate threshold amount based on your filing status: $250,000 for married filing jointly, $125,000 for married filing separately, or $200,000 for single, head of household, or qualifying widow(er).

- Subtract line 5 from line 4. If the result is zero or less, enter -0-.

- Multiply the amount from line 6 by 0.9% (0.009) and enter the result on line 7.

- Continue to complete Part II, by providing the total Medicare tax withheld from any Form W-2 in line 20.

- In Part IV, enter your self-employment income in line 6 as needed, and continue as instructed.

- Once all sections are completed, review your entries for accuracy.

- Save your changes, and then download, print, or share the completed form as required.

Complete your IRS documents online for a streamlined tax filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Filling out a W9 form as an individual requires you to maintain clarity and accuracy. Start by providing your name and address as it appears on your tax return, then include your Social Security number. Ensure you sign and date the form, indicating that the information is correct. For assistance, you can refer to reliable resources such as US Legal Forms to complete this process with confidence.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.