Loading

Get Irs 8938 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8938 online

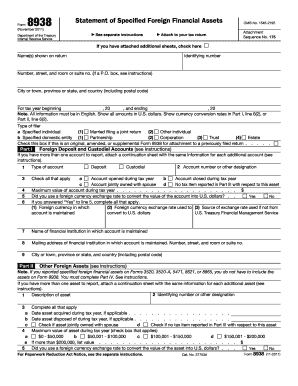

This guide will assist you in completing the IRS 8938 form, which is the Statement of Specified Foreign Financial Assets. Following these steps will help ensure that you accurately report your foreign assets as required by the IRS.

Follow the steps to fill out the IRS 8938 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by identifying yourself in the form. Fill in your name, identifying number, and any information as requested in Part I.

- Proceed to Part II, where you will summarize your foreign deposit and custodial accounts. Enter the number of accounts and their maximum value.

- In Part III, report any other foreign assets you have. Provide details for each asset, including identifiers, descriptions, and maximum values.

- Complete Part IV to summarize tax items attributable to your specified foreign financial assets. Ensure you follow the instructions carefully.

- Fill out Part V if applicable, by detailing information regarding any foreign deposit and custodial accounts that were closed during the tax year.

- Review all entered information for accuracy. If you have additional accounts or assets to report, prepare continuation statements as necessary.

- Once all sections are completed, you can save your changes, download the document, or print it for submission.

Complete your IRS 8938 form online today to ensure compliance with your reporting obligations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The income limit for filing Form 8938 depends on your filing status. For single filers, if your total annual income is over $200,000, you must report your foreign assets using IRS 8938. For married individuals filing jointly, the threshold is $400,000. Always verify these limits, as they can change.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.