Loading

Get Irs 8917 2016

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8917 online

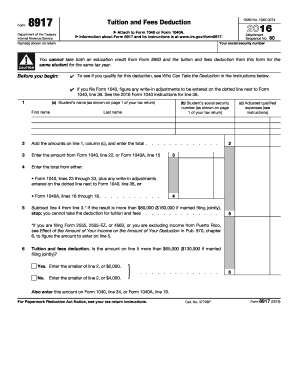

Filling out the IRS Form 8917 can seem daunting, but with this guide, you will have a comprehensive, step-by-step approach to complete the form online efficiently. This form is essential for the tuition and fees deduction, allowing eligible taxpayers to reduce their taxable income.

Follow the steps to fill out the IRS 8917 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your social security number in the designated field. Ensure accuracy, as this number is essential for processing your tax return.

- Proceed to line 1, where you will list the student’s name and social security number for whom you are claiming the deduction.

- On line 2, sum the amounts from column (c) of line 1 for each qualified student, entering that total in the specified field.

- In line 3, enter the amount from Form 1040, line 22, or Form 1040A, line 15.

- For line 4, identify and enter the adjusted qualified expenses. This includes reviewing other related lines on your Form 1040 or 1040A.

- Subtract the amount on line 4 from line 3. If this result exceeds $80,000 for single filers ($160,000 if married filing jointly), you cannot claim the deduction.

- On line 6, assess your situation: if the amount from line 5 is greater than $65,000 (or $130,000 for joint filers), enter the smaller of line 2 or $2,000. Otherwise, enter the smaller of line 2 or $4,000.

- Finally, be sure to enter this deduction amount onto either Form 1040, line 34, or Form 1040A, line 19.

- Review your entries for accuracy. Save your changes, and when finalized, download, print, or share the form as needed.

Take action now by filling out your IRS 8917 form online to maximize your potential tuition and fees deduction.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To report tuition payments, you should start by gathering all relevant receipts and records of tuition expenses. These expenses can be claimed using Form 8917 during tax filing. Accurate reporting of these payments ensures you can take full advantage of any credits or deductions available to you, maximizing your potential tax savings.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.