Loading

Get Auto Repossession Hold Harmless 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Auto Repossession Hold Harmless online

Filling out the Auto Repossession Hold Harmless form online is essential for authorizing Auto Repossession LLC to act on your behalf. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the Auto Repossession Hold Harmless form online.

- Press the ‘Get Form’ button to access the Auto Repossession Hold Harmless form and open it in your preferred editor.

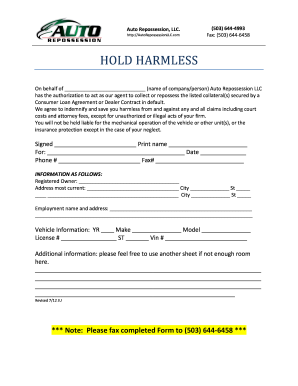

- In the first field, enter the name of the company or person authorizing Auto Repossession LLC to act as their agent.

- State your agreement by confirming that you will indemnify and save Auto Repossession LLC harmless from claims, except for unauthorized or illegal acts.

- Sign the document in the designated area, and print your name below the signature.

- Enter the date of signing in the provided space to indicate when this authorization takes effect.

- Fill in your contact information: provide your phone number and fax number if available.

- Complete the Registered Owner section with the full name and the most current address of the registered owner.

- Provide vehicle information, including year, make, model, license number, state, and VIN.

- If you need more space, use an additional sheet to provide further details.

- Once the form is completed, review all entries for accuracy. Save your changes, and prepare to fax the completed form to the provided fax number.

Complete your documents online today for efficient processing.

To halt a repossession process, you can negotiate with the lender by making a payment or setting up a payment plan. Additionally, you may exercise your right to redeem the vehicle by paying the total outstanding debt. If repossession proceedings have begun, consulting with a legal expert may provide options to file a response or seek an Auto Repossession Hold Harmless agreement to protect your interests.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.