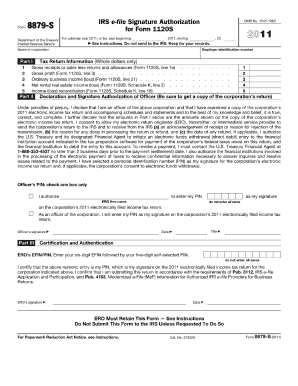

Get Irs 8879-s 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 8879-S online

How to fill out and sign IRS 8879-S online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When individuals aren’t linked with document administration and legal processes, completing IRS forms can be highly stressful. We understand the significance of accurately finalizing documents.

Our service offers a solution to simplify the process of submitting IRS documents as much as possible.

Utilizing our service can certainly facilitate professional filling of IRS 8879-S. We will ensure everything is arranged for your ease and simplicity in work.

- Click the button Get Form to access it and begin editing.

- Complete all necessary fields in your document using our robust and user-friendly PDF editor. Activate the Wizard Tool to streamline the process even further.

- Verify the accuracy of the entered information.

- Add the date of completion for IRS 8879-S. Use the Sign Tool to create your unique signature for document validation.

- Conclude editing by selecting Done.

- Send this document directly to the IRS in the most convenient way for you: via email, using online fax, or through traditional mail.

- You can print it out on paper when a hard copy is required, and download or save it to your preferred cloud storage.

How to Modify Get IRS 8879-S 2011: Personalize Forms Online

Utilize our extensive editor to transform a basic online template into a finished document. Read on to discover how to change Get IRS 8879-S 2011 online effortlessly.

Once you locate an ideal Get IRS 8879-S 2011, all you need to do is tailor the template to your specifications or legal stipulations. Besides filling out the editable form with precise information, you may need to remove some clauses in the document that do not pertain to your situation. Conversely, you might desire to introduce some absent elements in the original form. Our sophisticated document editing capabilities are the most effective approach to rectify and modify the form.

The editor allows you to alter the text of any form, even if the document is in PDF format. You can insert and delete text, add fillable fields, and implement further adjustments while preserving the original layout of the document. Additionally, you can reorganize the arrangement of the form by modifying the page sequence.

You do not need to print the Get IRS 8879-S 2011 to sign it. The editor includes electronic signature functionalities. Most forms already have designated signature areas. Thus, you simply need to add your signature and request one from the other signing parties via email.

Adhere to this step-by-step tutorial to generate your Get IRS 8879-S 2011:

Once all parties have finished the document, you will receive a signed copy which you can download, print, and share with others.

Our services allow you to save a significant amount of your time and minimize the likelihood of errors in your documents. Enhance your document processes with effective editing tools and a robust eSignature solution.

- Open the desired form.

- Utilize the toolbar to customize the template to your liking.

- Complete the form providing precise information.

- Click on the signature area and add your electronic signature.

- Send the document for signature to other participants if needed.

Get form

Related links form

The IRS 8879 Corp is filed by tax professionals who prepare tax returns for C Corporations. This form acts as a signature authorization for electronic filings, ensuring that the tax return is submitted correctly. If you are working with a tax preparer for your C Corporation, they will handle this process for you. Understanding who files these forms helps clarify your responsibilities as a business owner.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.