Loading

Get Irs 8879-c 2016

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8879-C online

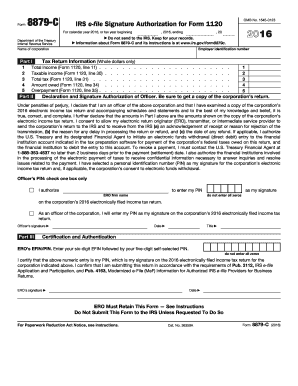

Form 8879-C is an important document used by corporate officers to electronically sign a corporation’s income tax return and, if necessary, authorize electronic funds withdrawal. This guide provides step-by-step instructions to help you complete the form efficiently online.

Follow the steps to fill out the IRS 8879-C accurately.

- Use the ‘Get Form’ button to obtain the IRS 8879-C form and open it in the editor.

- At the top of the form, enter the employer identification number and the name of the corporation.

- In Part I, provide the Tax Return Information. Enter rounded whole dollar amounts from your Form 1120 for total income (line 11), taxable income (line 30), total tax (line 31), amount owed (line 34), and overpayment (line 35).

- In Part II, declare and authorize the officer's signature. Confirm that the amounts entered in Part I are correct. Indicate if you consent to allow the electronic return originator (ERO) to use your PIN for submission.

- The corporate officer must choose a personal identification number (PIN) for their electronic signature and enter it as required, ensuring it is not all zeros. This PIN can be entered directly or authorized for the ERO to input.

- Complete the officer’s signature, date, and title in Part II. Be sure to retain a copy of the corporation’s returns for your records.

- In Part III, the ERO will enter their six-digit EFIN followed by their self-selected PIN for signature confirmation.

- Finally, save your changes, then download, print, or share the completed form as needed.

Complete your IRS 8879-C form online now to ensure timely filing of your corporate taxes.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The key distinction between IRS 8879 and 8453 is in their respective use cases. IRS 8879 serves as a declaration form for authors of electronic returns, while Form 8453 acts as a signature document verifying that the filing process has been authorized by the taxpayer. Understanding these forms helps to navigate the e-filing landscape more effectively.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.