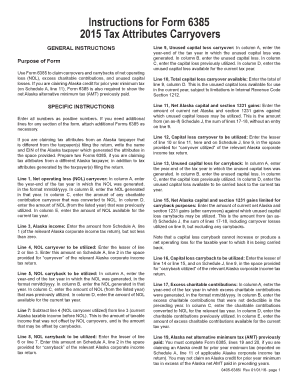

Get Ak 0405-6385i 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign AK 0405-6385i online

How to fill out and sign AK 0405-6385i online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

If the tax timeframe commenced unexpectedly or perhaps you simply overlooked it, it might likely lead to complications for you.

AK 0405-6385i is not the easiest one, but there is no reason for alarm in any scenario.

By using our comprehensive digital service and its useful tools, submitting AK 0405-6385i becomes simpler. Don’t hesitate to utilize it and allocate more time to your hobbies instead of preparing documents.

- Open the document with our robust PDF editor.

- Complete all the necessary information in AK 0405-6385i, using the fillable fields.

- Add images, marks, checkboxes, and text boxes, if required.

- Repeated information will be automatically populated after the initial entry.

- In case of challenges, activate the Wizard Tool. It provides helpful hints for easier completion.

- Remember to include the filing date.

- Create your distinct signature once and place it in all the required fields.

- Review the information you have entered. Rectify errors if needed.

- Click on Done to finalize the modifications and choose your preferred method of submission. You can opt for virtual fax, USPS, or email.

- You can even download the document to print it later or upload it to cloud storage such as Google Drive, Dropbox, etc.

How to modify Get AK 0405-6385i 2015: tailor forms online

Locate the accurate Get AK 0405-6385i 2015 template and amend it instantly.

Streamline your documentation with a clever document modification tool for online forms.

Your everyday workflow with documentation and forms can be enhanced when you have everything needed in one location. For example, you can find, acquire, and modify Get AK 0405-6385i 2015 in a single browser tab.

If you require a particular Get AK 0405-6385i 2015, it is easy to locate it using the intelligent search engine and access it immediately. You don’t need to download it or seek a third-party editor to modify it and insert your information. All the resources for productive work come in one consolidated solution.

Make additional custom modifications with available tools.

- This modification solution enables you to customize, complete, and endorse your Get AK 0405-6385i 2015 form directly on the spot.

- After finding a suitable template, click on it to initiate the editing mode.

- Upon opening the form in the editor, you have all the necessary tools at your disposal.

- You can effortlessly complete the designated fields and remove them if needed with a straightforward yet versatile toolbar.

- Implement all changes immediately, and sign the form without leaving the tab by simply clicking the signature field.

Get form

Related links form

Filling out your withholding form involves providing your personal information and determining your allowances. For the AK 0405-6385i, assess your financial situation and make sure you know how many allowances to claim. If you're unsure, uslegalforms offers various tools and resources to help streamline this process.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.