Loading

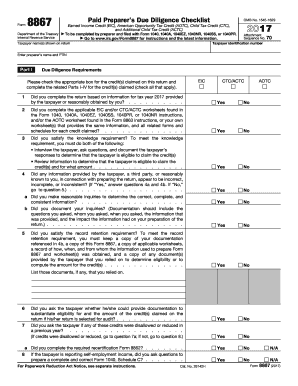

Get Irs 8867 2017

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8867 online

This guide provides comprehensive instructions for completing the IRS Form 8867 online, ensuring that users can navigate the required fields with confidence. By following this detailed process, you will be equipped to fulfill your obligations effectively and accurately.

Follow the steps to fill out the IRS 8867 form online.

- Press the ‘Get Form’ button to access the form and open it in the editor.

- Review the form's introductory section. Ensure that you are familiar with the context of the Earned Income Credit, American Opportunity Tax Credit, Child Tax Credit, and Additional Child Tax Credit.

- In Part I, indicate the credits being claimed by checking the appropriate boxes. Make sure to complete the related parts for each credit selected.

- Respond to the due diligence questions in Part I. For each statement, answer 'Yes' or 'No' as applicable. Ensure that you have all relevant documentation to support your answers.

- Moving to Parts II, III, and IV, answer any additional questions based on whether the taxpayer is claiming the Earned Income Credit, Child Tax Credit, or American Opportunity Tax Credit. Each section contains specific inquiries related to eligibility and substantiation.

- In Part V, confirm your compliance with all due diligence requirements. Check the relevant boxes and certify that the information provided is accurate to the best of your knowledge.

- After completing the form, save your changes. You may also choose to download, print, or share the form as necessary.

Complete your IRS documents online today to ensure accurate and timely filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You can access an IRS tax booklet online by visiting the IRS website's 'Forms and Publications' section. Many local libraries and tax offices also carry printed versions of these booklets. For specific information regarding IRS 8867, consider checking platforms that offer forms and legal documentation, such as US Legal Forms.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.