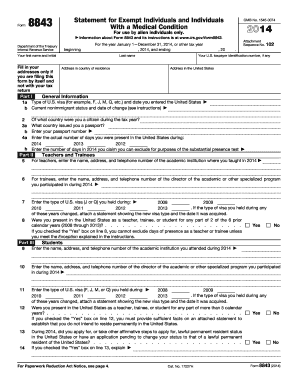

Get Irs 8843 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 8843 online

How to fill out and sign IRS 8843 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When individuals aren’t connected with document management and legal procedures, completing IRS forms can be quite challenging. We fully recognize the importance of accurately finalizing paperwork.

Our service provides the capability to simplify the task of submitting IRS forms as much as possible. Follow these instructions to swiftly and accurately fill in IRS 8843.

Utilizing our robust solution will enable professional completion of IRS 8843. Make everything for your ease and secure work.

- Click the button Get Form to access it and begin editing.

- Complete all required fields in the document using our efficient and user-friendly PDF editor. Activate the Wizard Tool to facilitate the process.

- Verify the accuracy of the provided information.

- Include the date of completing IRS 8843. Utilize the Sign Tool to add your signature for record validation.

- Finish editing by clicking on Done.

- Submit this document to the IRS in the most convenient way for you: via email, digital fax, or regular mail.

- You have the option to print it on paper if a copy is necessary and download or save it to your chosen cloud storage.

How to modify Get IRS 8843 2011: personalize forms digitally

Experience a stress-free and paperless method of operating with Get IRS 8843 2011. Utilize our dependable online solution and conserve a significant amount of time.

Creating every document, including Get IRS 8843 2011, from the ground up demands excessive effort, so possessing a reliable platform of pre-prepared form templates can work wonders for your efficiency.

However, utilizing them can pose challenges, particularly regarding PDF files. Fortunately, our extensive library includes a built-in editor that enables you to swiftly complete and modify Get IRS 8843 2011 without having to depart from our site, ensuring that you won’t waste time altering your documents. Here’s what you can accomplish with your document using our service:

Whether you need to handle editable Get IRS 8843 2011 or any other template found in our catalog, you are on the right path with our online document editor. It's straightforward and secure and doesn't require you to have specialized technical knowledge. Our web-based solution is designed to manage virtually everything you can conceive regarding file modification and execution.

Disregard the traditional method of managing your forms. Opt for a more effective choice to assist you in streamlining your tasks and reducing reliance on paper.

- Step 1. Find the required form on our site.

- Step 2. Click Get Form to access it in the editor.

- Step 3. Utilize specialized editing tools that allow you to insert, delete, comment, and highlight or obscure text.

- Step 4. Create and incorporate a legally-binding signature into your document by using the sign feature from the upper toolbar.

- Step 5. If the template layout doesn’t match your needs, use the tools on the right to remove, add, and rearrange pages.

- Step 6. Introduce fillable fields so other individuals can be invited to complete the template (if necessary).

- Step 7. Share or transmit the document, print it, or select the format in which you'd like to receive the file.

Get form

Related links form

Yes, for certain non-resident aliens, IRS 8843 is mandatory even if they are not required to file taxes. This includes most international students on temporary visas. Failure to file may lead to complications with your tax status or residency claims in the U.S.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.