Loading

Get Irs 8824 2018

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8824 online

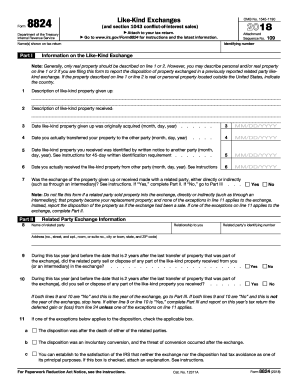

Filling out the IRS 8824 form can be a straightforward process when you have clear guidance. This guide will provide step-by-step instructions to help you complete the Like-Kind Exchange form accurately online.

Follow the steps to effectively complete the IRS 8824 form.

- Click ‘Get Form’ button to access the form and open it in the designated editor.

- Enter your identifying number and the names shown on your tax return at the top of the form.

- In Part I, provide detailed descriptions of the like-kind property given up and received in lines 1 and 2. If applicable, indicate the country where the property is located for properties outside the United States.

- Fill in the dates for when the like-kind property was originally acquired (line 3), the date it was actually transferred to the other party (line 4), and the date you received the property (line 6). Ensure all dates are formatted as month/day/year.

- Answer the question about whether the exchange involved a related party (line 7). Depending on your answer, you may need to complete Part II.

- If applicable, in Part II, provide the name, relationship, identifying number, and address of the related party. Complete the subsequent questions regarding the sale or disposal of the like-kind property as needed.

- Proceed to Part III to report the realized gain or loss and any recognized gain. Fill in lines 12 through 25 as they apply to your exchange, ensuring you calculate all values accurately according to the instructions.

- If you are reporting deferrals related to conflict-of-interest sales, complete Part IV with the required information regarding your divested and replacement property.

- Once all sections of the form are completed, save your changes, and prepare to download, print, or share the form as necessary for your tax filing.

Start filling out your IRS 8824 form online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

In TurboTax, you will find prompts to enter your 1031 exchange information, specifically asking about the like-kind exchange on the tax return. You will need to follow their guided process for entering details from Form 8824. TurboTax simplifies this by providing specific fields to report your exchanged properties and gain. If you encounter any difficulties, US Legal Forms offers additional resources to assist you.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.