Get Ny C-ben 2006-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY C-BEN online

This guide provides clear and comprehensive instructions on completing the NY C-BEN online. Whether you are a first-time user or need a refresher, this step-by-step approach will assist you in effectively filling out the form.

Follow the steps to successfully complete the NY C-BEN form.

- Press the ‘Get Form’ button to access the form and open it in the appropriate online editor.

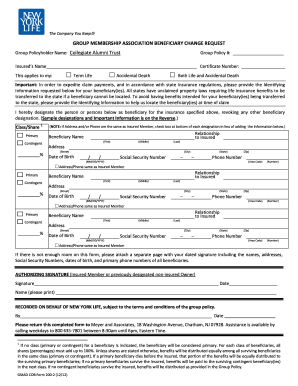

- Fill in the group policyholder name and group policy number at the top of the form. Ensure that you accurately enter the information as it appears on your policy documents.

- Provide the insured's name and certificate number in the designated fields. Ensure clarity in spelling to avoid any complications with processing.

- Indicate which type of coverage this request applies to by checking the appropriate box: Term Life, Accidental Death, or Both.

- Enter the identifying information for each beneficiary you wish to designate. Include the beneficiary's full name, relationship to the insured, address, date of birth, social security number, and phone number. If the address and phone number are the same as the insured member, you can check the corresponding box.

- For each beneficiary, specify the percentage share of benefits they are to receive. Ensure that the total percentages for all primary beneficiaries add up to 100%.

- If you need to designate more beneficiaries than there is space for on the form, please attach a separate sheet with their detailed information and your signature.

- After all fields are completed, the insured member or previously designated non-insured owner must provide their signature and the date of signing to finalize the request.

- Review all provided information for accuracy before submitting the request. Once confirmed, you can save changes, download a copy, print the completed form, or share it as needed.

Complete your NY C-BEN form online today for easy and efficient document management.

The highest income level to qualify for SNAP in New York is typically 200% of the federal poverty level, which varies by household size. For a family of four, this translates to an approximate monthly income limit of $4,600. It is essential to consider allowable deductions when calculating your eligibility. If you need detailed guidance on your specific situation and the application process, turn to US Legal Forms for assistance with NY C-BEN.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.