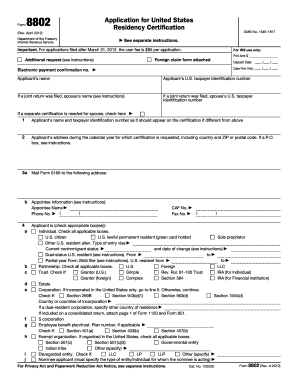

Get Irs 8802 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 8802 online

How to fill out and sign IRS 8802 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When individuals aren’t linked to document management and legal processes, completing IRS forms can be incredibly exhausting.

We fully understand the significance of accurately finalizing documents.

Using our ultimate solution will facilitate professional completion of IRS 8802. Ensure everything is comfortable and secure for your work.

- Click on the button Get Form to access it and start editing.

- Complete all necessary fields in the document using our robust PDF editor. Activate the Wizard Tool to simplify the process even further.

- Verify the accuracy of the information entered.

- Insert the date of filling IRS 8802. Utilize the Sign Tool to create your personal signature for the document validation.

- Finish editing by clicking Done.

- Submit this file straight to the IRS in the most convenient way for you: via email, digital fax, or postal service.

- You can print it on paper if a physical copy is required and download or save it to your chosen cloud storage.

How to modify Get IRS 8802 2012: personalize forms online

Forget a conventional paper-based method of completing Get IRS 8802 2012. Have the document finalized and validated swiftly with our superior online editor.

Are you required to alter and finalize Get IRS 8802 2012? With a professional editor like ours, you can accomplish this task in just a few minutes without needing to print and scan documents repeatedly. We offer entirely modifiable and straightforward document templates that will serve as a starting point and aid you in completing the necessary document template online.

All files, by default, include fillable fields you can interact with as soon as you access the form. However, if you wish to enhance the existing content of the form or add new material, you can choose from a range of customization and annotation tools. Emphasize, redact, and comment on the document; add checkmarks, lines, text boxes, graphics, notes, and remarks. Furthermore, you can effortlessly validate the form with a legally-binding signature. The finalized form can be shared with others, stored, sent to external applications, or converted into any other format.

You’ll never be mistaken by utilizing our web-based solution to finalize Get IRS 8802 2012 because it's:

Don't waste time completing your Get IRS 8802 2012 in an outdated manner - with pen and paper. Utilize our comprehensive solution instead. It offers you an extensive pack of editing choices, built-in eSignature features, and user-friendliness. What sets it apart from similar options is the team collaboration features - you can collaborate on documents with anyone, establish a well-organized document approval process from scratch, and much more. Test our online solution and receive the best value for your investment!

- Simple to set up and use, even for individuals who haven’t completed documents online previously.

- Robust enough to meet diverse editing requirements and document types.

- Safe and secure, ensuring your editing experience is protected every time.

- Accessible across multiple operating systems, making it easy to complete the document from anywhere.

- Able to generate forms based on pre-designed templates.

- Compatible with various file formats: PDF, DOC, DOCX, PPT, JPEG, etc.

Get form

To contact the IRS regarding Form 8802, you can call their dedicated hotline for forms and applications. Additionally, you may find valuable information on the IRS website about Form 8802, including FAQs and updates. If you require more tailored assistance, the US Legal Forms platform can provide guidance on how to proceed with your inquiries effectively.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.