Get Irs 872 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 872 online

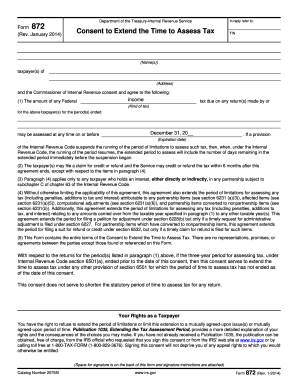

Filling out the IRS 872 form is an important step in extending the time to assess tax liabilities. This guide provides straightforward instructions to help users complete the form accurately and efficiently, ensuring compliance with IRS requirements.

Follow the steps to fill out the IRS 872 form online:

- Press the ‘Get Form’ button to access the form online and open it in the document editor.

- Enter the taxpayer identification number (TIN) in the designated field at the top of the form.

- Input the names of the taxpayers in the specified space to ensure proper identification.

- Provide the address of the taxpayer(s) as required on the form.

- Specify the kind of tax applicable for this consent, whether it is income tax or another type.

- Indicate the period ended by which the tax is assessed, along with the expiration date, stating that it can be on or before December 31 of the specified year.

- Review the consent agreement clauses regarding the extension of the time to assess tax and the rights of the taxpayer.

- If applicable, ensure the appropriate parties, including spouses or representatives, sign the form at the designated sections, following the signature instructions provided.

- Check all entered information for accuracy and completeness before finalizing.

- Save your changes, then proceed to download, print, or share the completed form as necessary.

Complete your IRS 872 form online today for a smoother tax assessment process.

Related links form

The IRS whistleblower threshold sets the minimum monetary value for reporting tax evasion or fraud to the IRS. Typically, this threshold relates to amounts that exceed $2 million or cases involving individuals with substantial income. If you have insider knowledge about tax fraud, understanding the IRS 872 framework helps optimize your reporting process. This can ultimately lead to significant rewards for whistleblowers.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.