Loading

Get Irs 8718 2010

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8718 online

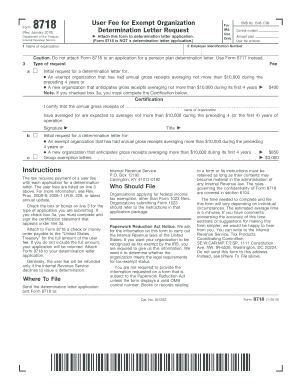

Filling out the IRS 8718 form is an essential step for organizations seeking a determination letter regarding their tax-exempt status. This guide provides a comprehensive overview of the form and detailed, step-by-step instructions for completing it online.

Follow the steps to complete the IRS 8718 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the first section, enter the name of your organization in the designated field.

- Next, provide your Employer Identification Number (EIN) in the provided space.

- Indicate the type of request you are submitting by checking the appropriate box in section 3. You will find two options: 3a for organizations expecting gross receipts not exceeding $10,000, and 3b for those expecting more than that.

- If you check box 3a, you must complete and sign the certification statement below it, confirming the expected average gross receipts.

- Confirm the user fee amount based on your request type: $400 for 3a, $850 for 3b, or $3,000 for group exemption letters.

- Attach a check or money order payable to the 'United States Treasury' for the full user fee amount required for your application.

- Once all fields are filled out, review your information for accuracy and completeness.

- Save your changes, and download or print the completed form for submission.

- Finally, send the determination letter application along with Form 8718 to the provided IRS mailing address.

Get started with your IRS 8718 form online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The IRS defines digital assets as digital representations of value that can be traded, transferred, or used as a medium of exchange. This includes cryptocurrencies, tokens, and certain types of digital currencies. As the landscape of digital assets evolves, understanding their treatment under IRS 8718 is crucial, and resources from US Legal Forms can help clarify current regulations.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.