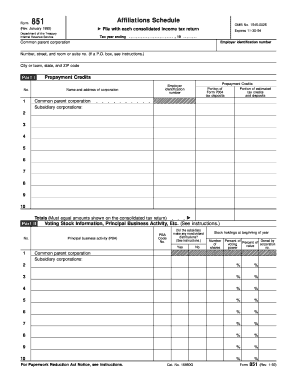

Get Irs 851 1992

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 851 online

How to fill out and sign IRS 851 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When you're not associated with document management and legal affairs, completing IRS forms can be rather stressful. We understand the importance of accurately filling out documents.

Our system provides the functionality to simplify the process of submitting IRS forms as straightforward as possible. Adhere to these suggestions to correctly and swiftly complete IRS 851.

Utilizing our ultimate solution can undoubtedly facilitate professional completion of IRS 851. Ensure everything is done for your comfortable and secure work.

- Click the button Get Form to access it and begin editing.

- Fill all required fields in your document using our valuable PDF editor. Activate the Wizard Tool to make the process even more effortless.

- Verify the accuracy of the entered information.

- Include the date of submitting IRS 851. Use the Sign Tool to create a personal signature for the document validation.

- Finish editing by clicking Done.

- Send this document directly to the IRS in the most convenient method for you: via email, using virtual fax, or postal service.

- You have the option to print it on paper when a copy is necessary and download or save it to your preferred cloud storage.

How to alter Get IRS 851 1992: personalize forms online

Streamline your document preparation procedure and tailor it to your requirements with just a few clicks. Complete and endorse Get IRS 851 1992 with a robust yet user-friendly online editor.

Handling documentation is often challenging, especially when you deal with it infrequently. It requires strict compliance with all protocols and precise completion of all sections with full and accurate information. Nevertheless, it frequently happens that you need to adjust the form or incorporate additional sections to fill out. If you need to refine Get IRS 851 1992 before submitting it, the easiest way to do so is by utilizing our powerful yet easy-to-navigate online editing tools.

This comprehensive PDF editing tool enables you to swiftly and effortlessly handle legal documents from any device with internet access, make essential modifications to the template, and add extra fillable sections. The service allows you to designate a specific field for each data type, such as Name, Signature, Currency, and SSN, etc. You can set them as required or conditional and determine who should complete each field by assigning them to a specific recipient.

Our editor is a flexible, feature-rich online solution that can assist you in promptly and effectively customizing Get IRS 851 1992 and other forms according to your specifications. Reduce document preparation and submission time and ensure your forms are polished without difficulty.

- Access the desired template from the library.

- Input information into the blanks with Text and utilize Check and Cross tools for the checkboxes.

- Employ the right-hand panel to modify the form with new fillable sections.

- Select the sections based on the type of information you want to gather.

- Designate these fields as mandatory, optional, and conditional and customize their sequence.

- Assign each section to a particular individual using the Add Signer tool.

- Confirm that you’ve implemented all necessary modifications and click Done.

Get form

To report wage theft, you should complete Form 3949-A, which allows you to submit information regarding suspected tax law violations. Provide as much detail as you can, including the employer's information. If your business is involved in tax reporting related to IRS 851, ensure you handle any wage-related issues appropriately.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.