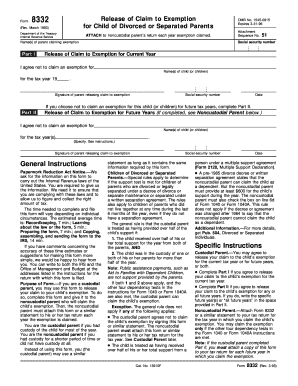

Get Irs 8332 1993

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 8332 online

How to fill out and sign IRS 8332 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When you aren't connected to document management and legal procedures, completing IRS forms can be surprisingly taxing.

We fully understand the importance of accurately finalizing paperwork. Our service provides the means to simplify the IRS document processing as much as possible.

You can print it on paper if a physical copy is required, and download or save it to your preferred cloud storage.

- Click the button Get Form to access it and start editing.

- Fill in all required fields in the document using our robust and user-friendly PDF editor. Activate the Wizard Tool to complete the process much more efficiently.

- Verify the accuracy of the provided information.

- Include the date of completion for IRS 8332. Use the Sign Tool to affix your signature for the document validation.

- Finalize editing by clicking Done.

- Send this document directly to the IRS in the most convenient method for you: via email, digital fax, or postal service.

How to Alter Get IRS 8332 1993: Personalize Forms Online

Position the appropriate document management features at your disposal. Fulfill Get IRS 8332 1993 with our trustworthy solution that includes editing and eSignature capabilities.

If you wish to execute and sign Get IRS 8332 1993 online smoothly, then our online cloud-based alternative is the ideal choice. We provide an extensive template-based library of ready-to-use forms you can modify and complete online. Additionally, you don't need to print the document or utilize external solutions to make it fillable. All necessary tools will be instantly accessible as soon as you open the file in the editor.

Let’s explore our online editing features and their primary attributes. The editor has an intuitive interface, so it won't take long to learn how to navigate it. We’ll examine three main sections that allow you to:

In addition to the features outlined above, you can secure your file with a password, include a watermark, convert the document to the desired format, and much more.

Our editor simplifies the process of completing and certifying the Get IRS 8332 1993. It allows you to accomplish nearly everything concerning document management. Furthermore, we consistently ensure that your experience modifying documents is secure and compliant with principal regulatory standards. All these factors enhance the enjoyment of utilizing our tool.

Obtain Get IRS 8332 1993, make the necessary edits and alterations, and download it in your preferred file format. Experience it today!

- Modify and annotate the template

- The upper toolbar provides tools that assist you in highlighting and obscuring text, without images or graphic elements (lines, arrows, and checkmarks, etc.), add your signature, initialize, date the form, and more.

- Arrange your documents

- Utilize the left toolbar if you wish to reorder the form or delete pages.

- Make them shareable

- If you wish to enable others to fill out the template and share it, you can use the tools on the right to insert various fillable fields, signature and date, text box, etc.

Get form

You can determine the custodial parent by evaluating where the child lives more than half the year. If the parents share custody, the arrangement outlined in any custody agreement generally plays a vital role. If there’s still uncertainty, completing IRS Form 8332 can help clarify which parent claims the child. This form also aids in official recognition of the custodial status.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.