Get Irs 8082 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8082 online

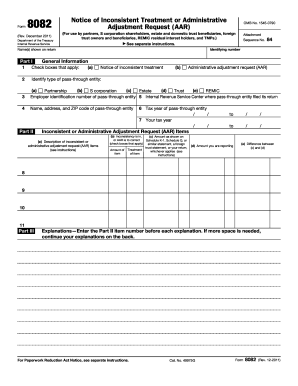

Filling out the IRS 8082 form, also known as the Notice of Inconsistent Treatment or Administrative Adjustment Request, is essential for various taxpayers, including partners and S corporation shareholders. This guide provides a clear step-by-step approach to assist you in completing the form accurately online.

Follow the steps to successfully complete the IRS 8082 form.

- Click ‘Get Form’ button to obtain the form and open it in the editor for completion.

- In Part I, provide your identifying number and the name(s) as shown on the return. Subsequently, check the boxes that apply in question 1 to identify your type of pass-through entity from the options given, such as partnership or S corporation.

- Fill in the employer identification number of the pass-through entity in the designated field and indicate the IRS Center where the pass-through entity filed its return.

- Complete the address details of the pass-through entity, including the name, address, and ZIP code.

- In Part II, specify whether you are submitting a Notice of inconsistent treatment or an Administrative adjustment request (AAR) by marking the appropriate box.

- Provide the tax year of the pass-through entity as well as your own tax year, clearly indicating the start and end dates.

- For each inconsistent or administrative adjustment item, describe the item, check which treatment of item is applicable, and fill in the amounts as per instructions. Record the amount as shown on Schedule K-1 or equivalent versus the amount you are reporting, along with the difference.

- In Part III, provide detailed explanations for each item referenced in Part II. Ensure to enter the corresponding item number before each explanation. If additional space is required, continue your explanations on the back of the form.

- Review all entries to confirm accuracy and completeness. Make sure to save changes, and you can choose to download, print, or share the completed form as necessary.

Complete the IRS 8082 form online today to ensure compliance and accuracy in your tax filings.

Get form

To talk to someone at the IRS, call 1-800-829-1040 and listen carefully to the options provided. Usually, pressing '0' can help you reach an operator more quickly. If addressing issues related to Form 8082, make sure to mention this specifically to the representative to receive accurate assistance. Staying calm and prepared with your questions can help ensure a smoother conversation.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.