Get Irs 656-b 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 656-B online

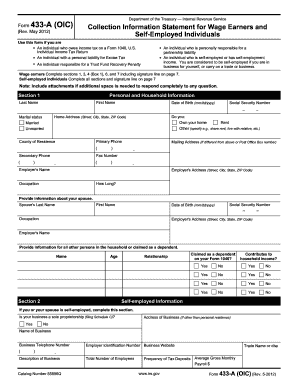

The IRS Form 656-B is an essential document for taxpayers who wish to settle their tax debts for less than the full amount owed through an Offer in Compromise. This guide provides clear, step-by-step instructions on how to accurately complete this form online, ensuring that you provide the necessary information to the IRS.

Follow the steps to complete your IRS 656-B form online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor. This will allow you to access the IRS 656-B for online completion.

- Provide your contact information in Section 1, including your name, address, and Social Security number. If this is a joint offer, include your partner's details.

- In Section 2, specify the tax periods and types of tax liabilities you wish to compromise, including any narratives necessary to explain your situation.

- In Section 3, select the reason for your offer, such as doubt as to collectibility or exceptional circumstances. Provide a detailed explanation if necessary.

- Complete Section 4 by checking the Low Income Certification box if applicable. This may exempt you from the application fee and payment requirements.

- Choose a payment option in Section 5. Specify whether you will pay your offer as a lump sum or in monthly installments, and include the necessary initial payment and application fee.

- Provide information on the source of funds for your payment in Section 7. This may be derived from personal loans, asset sales, or other means.

- Review the terms outlined in Section 8 and confirm your understanding of the conditions surrounding the acceptance of your offer.

- Sign and date the form in Section 9 as the taxpayer, ensuring all necessary signatures are included if applicable.

- Mail the completed application package, including the IRS 656-B and any supplementary forms, to the correct IRS facility based on your state.

Complete your IRS 656-B application online today to take the first step toward resolving your tax debts.

Get form

Related links form

The downside of an Offer in Compromise is that it may not be granted, leading to ongoing tax liability. Additionally, the IRS requires you to meet specific conditions, including financial disclosures, which some individuals may find uncomfortable. If rejected, you may need to explore other tax relief options. Understanding these implications is essential, and USLegalForms can help clarify your options and assist with your filing process.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.