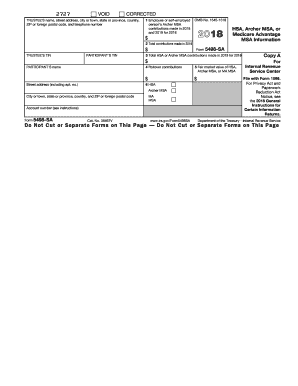

Get Irs 5498-sa 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 5498-SA online

How to fill out and sign IRS 5498-SA online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When people aren’t linked with document management and legal procedures, completing IRS forms can be rather challenging. We understand the importance of accurately finalizing paperwork.

Our online application provides a means to simplify the process of handling IRS documents as much as possible. Adhere to this guide to correctly and swiftly submit IRS 5498-SA.

Using our platform will enable professional completion of IRS 5498-SA. We will do everything for your convenience and efficiency.

- Click on the button Get Form to access it and begin editing.

- Complete all necessary fields in the selected document using our expert PDF editor. Activate the Wizard Tool to make the process even more straightforward.

- Verify the accuracy of the entered information.

- Include the completion date for IRS 5498-SA. Utilize the Sign Tool to create a unique signature for the document validation.

- Conclude editing by clicking Done.

- Send this document directly to the IRS in the most convenient manner for you: via email, using digital fax, or postal service.

- You can print it out on paper if a copy is needed and download or save it to your chosen cloud storage.

How to alter Get IRS 5498-SA 2016: personalize forms online

Select a dependable document editing option you can trust. Modify, finalize, and endorse Get IRS 5498-SA 2016 safely online.

Frequently, altering forms, like Get IRS 5498-SA 2016, can be troublesome, especially if you obtained them online or via email but lack access to specialized software. Certainly, you can employ some alternatives to navigate around it, but you might end up with a form that does not meet the submission criteria. Using a printer and scanner isn’t a viable choice either as it consumes time and resources.

We provide a more streamlined and effective approach to completing documents. An extensive collection of document templates that are simple to modify and certify, and make fillable for others. Our platform surpasses just a collection of templates. One of the most advantageous features of utilizing our services is that you can alter Get IRS 5498-SA 2016 directly on our site.

Being an online-based solution, it saves you from having to install any software. Moreover, not all corporate policies permit downloads on your work laptop. Here’s the simplest way to conveniently and securely complete your documents with our solution.

Eliminate the hassle of paper and other ineffective methods of finalizing your Get IRS 5498-SA 2016 or other documents. Use our tool instead, which includes one of the most comprehensive libraries of ready-to-edit forms along with powerful file editing services. It's straightforward and secure, potentially saving you a significant amount of time! Don’t just take our word for it, experience it yourself!

- Press the Get Form > to be promptly directed to our editor.

- Once opened, you can initiate the personalization process.

- Select checkmark or circle, line, arrow, cross, and other options to annotate your form.

- Choose the date option to insert a specific date into your template.

- Include text boxes, images, notes, and more to enhance the content.

- Utilize the fillable fields option on the right to insert fillable {fields.

- Select Sign from the upper toolbar to create and attach your legally-binding signature.

- Click DONE to save, print, and share or download the final {file.

Get form

Related links form

To report HSA contributions, refer to the IRS 5498-SA and enter the total contributions on your tax return, typically on Form 8889. Make sure the amounts align with what is shown on the form. By accurately entering this information, you can fully utilize the tax benefits associated with your Health Savings Account.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.