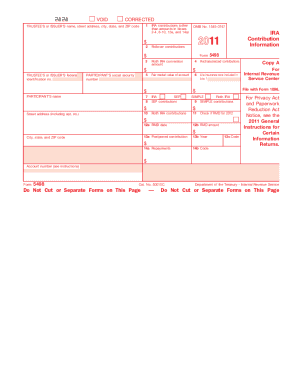

Get Irs 5498 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 5498 online

How to fill out and sign IRS 5498 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When individuals aren’t linked with document management and legal processes, submitting IRS forms can be fairly challenging. We recognize the importance of accurately completing paperwork. Our platform provides the solution to simplify the procedure of handling IRS forms as much as possible. Adhere to this guide to swiftly and correctly submit IRS 5498.

How you can file the IRS 5498 online:

Using our platform can undoubtedly facilitate professional completion of IRS 5498. Make everything for your ease and straightforward working.

Select the button Get Form to launch it and commence editing.

Complete all mandatory fields in the document utilizing our advanced PDF editor. Activate the Wizard Tool to make the process much simpler.

Verify the accuracy of entered information.

Include the date of completion for IRS 5498. Utilize the Sign Tool to create your signature for the document validation.

Conclude editing by clicking Done.

Submit this document directly to the IRS in the most convenient way for you: via email, using digital fax, or through traditional mail.

You can print it out if a physical copy is needed and download or save it to your chosen cloud storage.

How to modify Get IRS 5498 2011: personalize forms online

Your easily adjustable and modifiable Get IRS 5498 2011 template is readily accessible. Utilize our library equipped with an integrated online editor.

Do you delay preparing Get IRS 5498 2011 because you simply don't know where to start and how to proceed? We comprehend your feelings and have an excellent solution for you that has nothing to do with conquering your procrastination!

Our online collection of ready-to-edit templates enables you to filter through and select from thousands of fillable forms tailored for various objectives and situations. But acquiring the document is merely the beginning. We furnish you with all the necessary features to complete, sign, and modify the template of your choice without exiting our website.

All you need to do is to launch the template in the editor. Review the language of Get IRS 5498 2011 and verify whether it's what you’re seeking. Begin by completing the template using the annotation features to give your document a more structured and polished appearance.

Once you’ve finalized the template, you can obtain the file in any available format or select any sharing or delivery options.

Adherence to eSignature regulations governing the use of eSignature in online activities.

With our comprehensive tool, your completed forms will nearly always be legally binding and securely encoded. We guarantee the protection of your most sensitive information. Gain everything you need to produce a professionally appealing Get IRS 5498 2011. Make the right decision and try our platform today!

- Insert checkmarks, circles, arrows, and lines.

- Highlight, black out, and edit the existing text.

- If the template is also intended for other users, you can include fillable fields and share them for others to complete.

- A powerful suite of editing and annotation tools.

- An embedded legally-binding eSignature solution.

- The ability to create forms from the ground up or based on the pre-prepared template.

- Compatibility across various platforms and devices for enhanced comfort.

- Multiple options for safeguarding your documents.

- An extensive range of delivery methods for simplified sharing and distribution.

Get form

While not required to file your taxes, Form 5498-SA is beneficial for understanding your Health Savings Account contributions. Having this form helps you confirm that all your contributions align with the amounts you have documented. If you make contributions to your HSA, it's wise to keep it for reference, but it does not need to be submitted with your tax return.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.