Get Irs 5471 - Schedule J 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 5471 - Schedule J online

How to fill out and sign IRS 5471 - Schedule J online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

If you aren't linked to document management and legal processes, filing IRS documents will be quite challenging. We recognize the importance of accurately completing paperwork.

Our platform provides the solution to simplify the procedure of handling IRS forms as effortlessly as possible. Adhere to these recommendations to efficiently and correctly fill out IRS 5471 - Schedule J.

Leveraging our effective solution can certainly turn proficiently filling IRS 5471 - Schedule J into a reality. We will ensure everything is set for your comfortable and secure work.

Click the button Get Form to access it and start editing.

Complete all mandatory sections in the document using our robust and user-friendly PDF editor. Activate the Wizard Tool to make the process even easier.

Verify the accuracy of the information provided.

Add the date of completion for IRS 5471 - Schedule J. Utilize the Sign Tool to create your unique signature for document validation.

Conclude modifications by selecting Done.

Submit this document to the IRS in the most suitable method for you: via email, digital fax, or regular mail.

You can print it on paper when a copy is needed and download or store it in your preferred cloud storage.

How to Modify IRS 5471 - Schedule J 2012: Personalize Forms Online

Experience a hassle-free and paperless method of adjusting IRS 5471 - Schedule J 2012. Utilize our reputable online service and conserve significant time.

Creating every document, such as IRS 5471 - Schedule J 2012, from the ground up consumes excessive time, so having a reliable source of pre-prepared document templates can greatly enhance your productivity.

However, altering them can be challenging, particularly when dealing with PDF files. Thankfully, our vast collection features an integrated editor that allows you to effortlessly complete and modify IRS 5471 - Schedule J 2012 without leaving our site, ensuring your valuable time is not wasted adjusting your documents. Here’s what you can do with your file using our resources:

Whether you need to finalize an editable IRS 5471 - Schedule J 2012 or any other document in our library, you are on the right path with our online document editor. It's straightforward and secure, requiring no specialized technical knowledge. Our web-based tool is designed to handle practically everything related to document editing and execution.

Stop relying on traditional methods for managing your forms. Opt for a professional solution to streamline your tasks and reduce your dependence on paper.

- Step 1. Find the required document on our platform.

- Step 2. Click 'Get Form' to open it in the editor.

- Step 3. Utilize professional editing tools to add, delete, annotate, and highlight or obscure text.

- Step 4. Generate and affix a legally-binding signature to your document using the signature option from the top toolbar.

- Step 5. If the document format doesn’t meet your expectations, employ the tools on the right to eliminate, add, and rearrange pages.

- Step 6. Include fillable fields so other individuals can be invited to complete the document (if needed).

- Step 7. Distribute or send the document, print it, or choose the format in which you'd like to save the file.

Get form

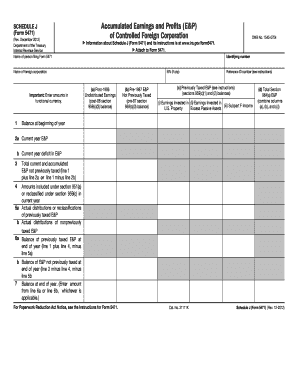

Form 5471 is completed by U.S. persons with a significant interest in a foreign corporation. This form includes various schedules, including the IRS 5471 - Schedule J, that detail financial information about the foreign entity. To accurately complete this form, many individuals turn to legal and tax professionals for expert guidance.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.