Get Irs 5329 2008

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 5329 online

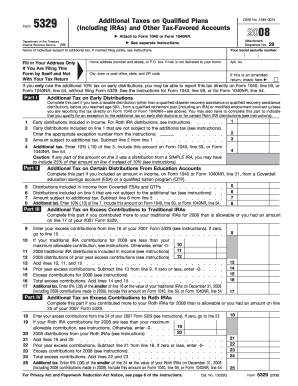

Filling out the IRS 5329 form can be straightforward with the right guidance. This form is essential for reporting additional taxes on qualified plans, including IRAs and other tax-favored accounts. This guide provides step-by-step instructions to help you successfully complete the form online.

Follow the steps to fill out the IRS 5329 form online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your name and Social Security number in the designated fields. If you are married and filing jointly, make sure to include your partner's name as well.

- Fill in your address only if you are filing this form by itself and not with your tax return. Ensure that the details are complete, including the apartment number, if applicable, as well as the city, state, and ZIP code.

- Indicate if this is an amended return by checking the appropriate box if applicable.

- Proceed to Part I, where you will report additional tax on early distributions. Input the total early distributions included in your income on line 1, and if applicable, the exceptions on line 2.

- Calculate the amount subject to additional tax by subtracting line 2 from line 1, and enter this figure on line 3. On line 4, calculate the additional tax by entering 10% of line 3.

- If you have reported distributions from education accounts or IRAs, repeat similar steps in Part II, Part III, Part IV, and so on as necessary, entering the required information in the respective lines.

- After completing all necessary parts, review your entries for accuracy.

- Finally, save your changes, and you may have options to download, print, or share the completed form as required.

Complete your IRS 5329 form online today to ensure accurate reporting of your additional taxes.

Get form

Related links form

You can find form 5329 on the IRS website or through various tax preparation software. If you are using a platform like TurboTax, it can generate the form based on your inputs. Additionally, USLegalForms frequently provides access to this form, ensuring you have the necessary tools to manage your IRS 5329 efficiently. Making use of these resources can streamline your filing experience.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.