Loading

Get Ak 0405-6321i 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AK 0405-6321i online

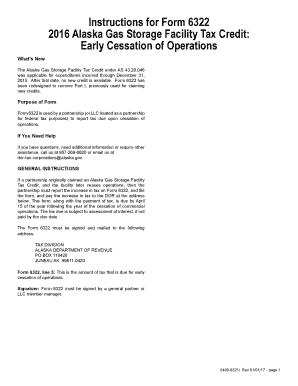

This guide will walk you through the process of completing the AK 0405-6321i form online. Designed to be user-friendly, this document assists partnerships in reporting tax obligations when they cease operations.

Follow the steps to complete the AK 0405-6321i form accurately.

- Click the ‘Get Form’ button to access the AK 0405-6321i form and open it in the designated online interface.

- Identify the first section of the form where you will input your partnership name and relevant details. Ensure accuracy, as this information will be used for official purposes.

- Proceed to the next field to indicate the cessation date of operations. This date is critical for tax reporting and must reflect accurate operational timelines.

- In line 5 of the form, report the total tax due related to early cessation of operations. This amount must be calculated based on the guidelines provided in the form instructions.

- Review all provided information carefully for accuracy. Mistakes can lead to delays in processing or potential penalties.

- Once confirmed, ensure that the form is signed by a general partner or LLC member manager. This signature is necessary for validation.

- Finally, save your changes, and decide whether to download, print, or share the completed form as needed before submission.

Complete your AK 0405-6321i form online today for a smooth filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Amending a tax return can be beneficial if you discover mistakes that may lead to a refund or correct your tax liability. It allows you to comply with IRS regulations and rectify previous errors. When considering the AK 0405-6321i, assess your situation carefully, and platforms like UsLegalForms can guide you in making informed decisions.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.