Get Al Ador Int-2 2014-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

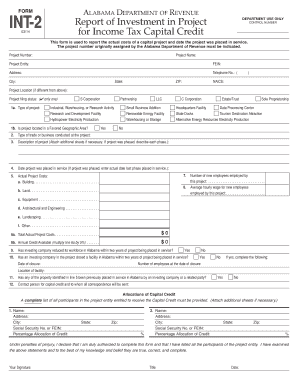

Tips on how to fill out, edit and sign AL ADoR INT-2 online

How to fill out and sign AL ADoR INT-2 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

If the tax season began suddenly or you simply overlooked it, it might likely lead to challenges for you. AL ADoR INT-2 is not the simplest form, but you have no reason to stress at any rate.

By using our robust solution, you will learn how to complete AL ADoR INT-2 even in circumstances of urgent time shortages. The only requirement is to adhere to these simple guidelines:

With our effective digital solution and its beneficial tools, completing AL ADoR INT-2 becomes more manageable. Feel free to engage with it and spend more time on leisure activities rather than on administrative tasks.

Access the document with our sophisticated PDF editor.

Complete all necessary details in AL ADoR INT-2, utilizing the fillable fields.

Add images, crosses, checkboxes, and text boxes if necessary.

Duplicate information will be populated automatically after the initial entry.

If you encounter any challenges, utilize the Wizard Tool. You will receive helpful pointers for easier completion.

Remember to include the application date.

Design your unique signature once and place it in the designated fields.

Verify the information you have entered. Amend any errors if needed.

Select Done to finish editing and choose how you will submit it. You can opt for virtual fax, USPS, or email.

You can also download the document to print it later or upload it to cloud storage services like Google Drive, Dropbox, etc.

How to modify Get AL ADoR INT-2 2014: personalize forms online

Choose a trustworthy document editing solution you can depend on. Modify, complete, and sign Get AL ADoR INT-2 2014 safely online.

Frequently, dealing with documents, such as Get AL ADoR INT-2 2014, may prove difficult, particularly if you acquired them via the internet or email but lack access to specific software. Naturally, you might discover some alternatives to manage it, yet you could end up with a document that fails to meet submission criteria. Utilizing a printer and scanner is not a feasible option either due to the high consumption of time and resources.

We provide a more straightforward and efficient method for completing documents. A comprehensive collection of form templates that are simple to modify and validate, making them fillable for others. Our platform offers much more than just a set of templates. One of the outstanding features of using our service is that you can edit Get AL ADoR INT-2 2014 directly on our site.

Being a web-based service, it eliminates the need to download any software. Moreover, not all workplace rules allow you to install it on your company laptop. Here's the most effective way to easily and securely finalize your forms using our platform.

Bid farewell to paper and other ineffective methods for processing your Get AL ADoR INT-2 2014 or additional forms. Utilize our tool that features one of the largest libraries of customizable templates and an effective file editing capability. It's simple and secure, and can save you a great deal of time! Don’t just take our word for it, experience it for yourself!

- Click the Get Form > you’ll be immediately directed to our editor.

- Once opened, you can initiate the editing procedure.

- Choose checkmark or circle, line, arrow, and cross among other options to annotate your document.

- Select the date option to incorporate a specific date into your document.

- Insert text boxes, images, notes, and more to enhance the content.

- Employ the fillable fields choice on the right to add fillable {fields.

- Click Sign from the top toolbar to create and affix your legally-binding signature.

- Press DONE and save, print, share, or download the final {file.

Related links form

Filling out a withholding allowance form requires you to provide personal information, including your filing status and number of dependents. Accurately estimate your income and deductions to determine the correct number of allowances to claim. It's essential to refer to the AL ADoR INT-2 to ensure you follow state-specific guidelines while completing this form.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.