Loading

Get Irs 4419 2016

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 4419 online

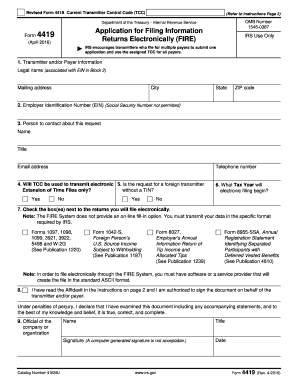

Filling out the IRS Form 4419 is essential for those wishing to file information returns electronically. This guide provides a clear and structured approach to completing the form accurately and efficiently.

Follow the steps to complete your IRS Form 4419 online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- In Block 1, enter the legal name associated with the Employer Identification Number (EIN) provided in Block 2 and complete the mailing address, including city, state, and ZIP code.

- In Block 2, input the Employer Identification Number (EIN). Note that Social Security Numbers are not permitted.

- For Block 3, provide the name, title, email address, and telephone number of a contact person who is knowledgeable about this application.

- In Block 4, select whether you are applying for a Transmitter Control Code (TCC) solely for the electronic filing of Form 8809.

- In Block 5, indicate if you are a foreign transmitter without a nine-digit Taxpayer Identification Number.

- Fill out Block 6 by entering the tax year you wish to begin filing electronically.

- In Block 7, check all the relevant boxes next to the returns you will file electronically. Each box checked will result in a separate TCC being assigned.

- In Block 8, confirm that you have read the affidavit and are authorized to sign the document. Provide your name, title, and signature (a computer-generated signature is not acceptable).

- Finally, date the form in Block 9 and review all information provided before submission.

- Save changes, download, print, or share the completed form as needed.

Complete your IRS Form 4419 online for efficient processing and submission.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The IRS response time to a fax can vary based on their workload and the type of correspondence submitted. Typically, you might expect a response within a few weeks, but it’s wise to check directly with the IRS for updates on your specific case. To streamline the process, consider utilizing electronic filing options such as those facilitated by IRS form 4419.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.