Loading

Get Irs 433-f 2003

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 433-F online

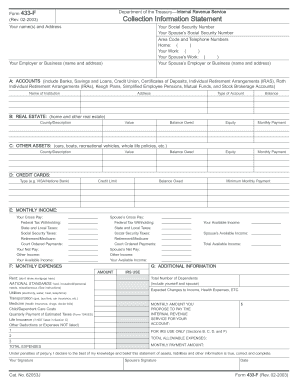

Completing the IRS 433-F, also known as the Collection Information Statement, is essential for individuals seeking to manage their tax liabilities with the Internal Revenue Service. This guide provides step-by-step instructions to help users fill out the form accurately and efficiently online.

Follow the steps to complete your IRS 433-F form online

- Click 'Get Form' button to obtain the form and open it online.

- Enter your name, address, and Social Security number in the designated fields. If applicable, include your spouse’s information.

- Provide your area code and telephone numbers for home and work under the contact information section.

- In Section A, list all accounts such as banks, savings and loans, IRAs, and brokerage accounts. Include the name, address, type of account, balance, balance owed, equity, and monthly payment.

- For Section B, provide details about any real estate you own or are purchasing. Include descriptions, counties, and market values.

- Section C requires you to detail other assets like cars and recreational vehicles. Include their descriptions and values.

- In Section D, list all credit cards, including limits and balances owed.

- Fill out Section E with your monthly income. Record gross pay, taxes withheld, and net pay for both you and your spouse, along with any other income sources.

- In Section F, enter your monthly expenses, categorizing them into needs, utilities, transportation, medical, and child care. Calculate your total expenses.

- Complete Section G by indicating the total number of dependents and any expected changes to income or expenses.

- Certification requires both you and your spouse to provide signatures. Ensure that the information presented is true to the best of your knowledge and belief.

- After filling out the form, save your changes. You may then download, print, or share the completed form as needed.

Start filling out your IRS 433-F form online today to efficiently manage your tax situation.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

You should mail your installment agreement request to the IRS address specified for your state. This address is typically listed on the IRS website or on the form instructions. If you are using uslegalforms, you can easily locate the correct mailing address and ensure that your request is submitted properly.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.