Loading

Get Irs 433-d 2017

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 433-D online

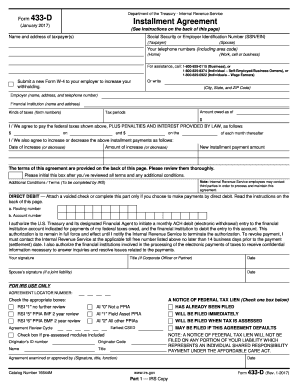

Filling out the IRS 433-D form online is a straightforward process that enables taxpayers to set up an installment agreement for paying federal taxes. This guide provides comprehensive, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the IRS 433-D form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name and address of the taxpayer(s) in the designated fields. Ensure all names are accurately entered, especially if it is a joint return.

- Fill in the Social Security or Employer Identification Number (SSN/EIN) for both the taxpayer and spouse, if applicable.

- Provide your telephone numbers, including area codes, for both home and work or cell/business numbers.

- Complete the employer's details, including name, address, and telephone number.

- Identify your financial institution by providing its name and address.

- Enter the total amount owed as of the specified date and include the relevant tax periods and kinds of taxes (form numbers).

- Specify your agreement to pay the federal taxes shown, alongside any penalties and interest as required by law. Clearly note the agreed payment schedule, detailing the amounts and due dates.

- If applicable, indicate any changes in the installment payments and include details about the amount of increase or decrease and the new installment payment amount.

- Review the terms of the agreement carefully. Once satisfied, initial the designated box to confirm your understanding.

- If opting for direct debit, provide your routing number and account number for the financial institution account set for payments. Attach a voided check if necessary.

- Sign and date the form. If applicable, the spouse should also sign and date the form.

- Once all fields are completed, save the changes and download or print the form for your records. Share it as required or submit it to the IRS based on the provided instructions.

Start completing your IRS 433-D form online today to set up your installment agreement.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Filing Form 433-D is straightforward. First, download the form from the IRS website or use a legal service like US Legal Forms for assistance. Fill out the required details accurately, and submit it via the IRS’s designated channels. Ensure you keep a copy for your records, as it serves as an important document in your communication with the IRS regarding installment agreements.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.