Loading

Get Irs 433-a (oic) 2014

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 433-A (OIC) online

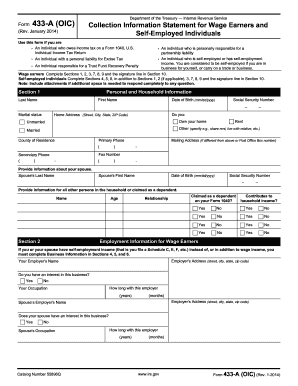

The IRS 433-A (OIC) is a crucial document for individuals seeking to settle tax debts through an offer in compromise. Completing this form accurately is essential for ensuring the IRS has the necessary information to evaluate your proposal.

Follow the steps to fill out the IRS 433-A (OIC) online.

- Click ‘Get Form’ button to obtain the IRS 433-A (OIC) form and open it in your preferred editing tool.

- Begin by filling Section 1 with your personal and household information, including your name, marital status, date of birth, and social security number. Ensure to provide your home address and primary contact details.

- In Section 2, enter employment information if you are a wage earner, providing details of your employer and occupation. If self-employed, you will need to complete additional business-related sections.

- Proceed to Section 3 to disclose personal asset information. List your cash, investments, real estate properties, and vehicles, ensuring to note any loan balances and calculating the total value of each asset.

- If self-employed, complete Sections 4, 5, and 6 to outline your business information, including assets and income. Include business revenues, expenses, and any outstanding debts related to your business.

- In Section 7, provide details of your household monthly income and expenses. Accurately summarize gross income from all household members and list monthly expenses in accordance with IRS standards.

- Section 8 is dedicated to calculating your minimum offer amount. Enter details from previous sections to determine the total available assets and expected future income based on your payment plan.

- Complete Section 9, providing any additional information the IRS may need, including details on bankruptcy or lawsuits.

- Finally, in Section 10, sign the form, verifying that all information provided is true and complete. Ensure all necessary attachments are included before submitting.

- Once you have completed all sections, save your changes, and download or print the finalized form for submission.

Start filling out your IRS 433-A (OIC) online today to take control of your tax situation.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

IRS qualified expenses generally refer to the necessary living costs that the IRS acknowledges as essential for maintaining a reasonable lifestyle. These include basic needs like housing, food, and medical expenses. It's important to distinguish these from discretionary spending when filling out forms like IRS 433-A (OIC) to ensure you're treated fairly.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.