Get Irs 4136 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 4136 online

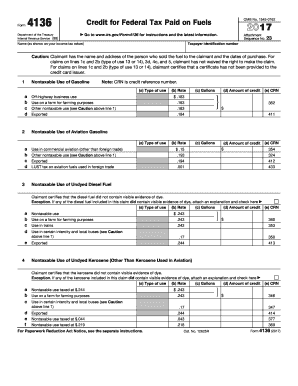

The IRS 4136 form, also known as the credit for federal tax paid on fuels, is essential for individuals and businesses looking to claim credits for certain nontaxable uses of fuel. This guide provides clear, step-by-step instructions on completing the form online, ensuring you have the necessary information to successfully submit your credits.

Follow the steps to complete the IRS 4136 online.

- Click the ‘Get Form’ button to access the IRS 4136 form in your browser or preferred editing program.

- Provide your taxpayer identification number in the designated field. This should match the information on your income tax return.

- Enter your name as it appears on your income tax return in the appropriate section.

- Record the name and address of the individual or entity that sold you the fuel, along with the purchase dates, as required for validating your claim.

- In section 1, indicate the type of fuel usage – choose from options such as nontaxable use of gasoline, off-highway business use, or use on a farm for farming purposes. Fill in the gallons used and calculate the amount of credit based on the rate provided.

- For sections 2, 3, and 4, follow similar instructions to document the appropriate nontaxable uses for aviation gasoline and undyed diesel fuel, entering the type of use, gallons, and relevant credits.

- Continue filling in details for any additional sections applicable to your fuel claims, ensuring you provide rates and gallons for each type of fuel usage as per the guidelines on the form.

- Once all sections are completed, review the form for accuracy and completeness to avoid delays in processing your claim.

- You may now save changes to the form, download it for your records, print a hard copy for submission, or share it as necessary.

Start filling out your IRS 4136 form online today to claim your credits for federal tax paid on fuels.

Get form

Filling out a tax exemption form involves specifying your reason for the exemption clearly. You’ll typically provide personal details and documentation supporting your exemption claim. It's advisable to consult IRS guidelines or consider using platforms like UsLegalForms to ensure your IRS 4136-related forms are filled out correctly.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.