Loading

Get Irs 2159 2007

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 2159 online

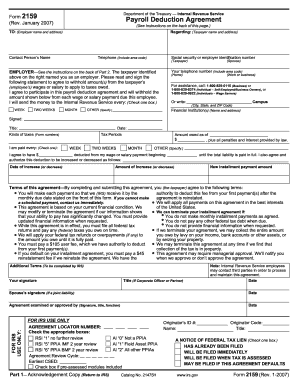

Filling out the IRS Form 2159, also known as the Payroll Deduction Agreement, is essential for managing tax payments through payroll deductions. This guide aims to provide clear, step-by-step instructions to ensure you complete the form accurately and efficiently online.

Follow the steps to fill out the IRS 2159 online successfully.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Complete the employer information section by entering the employer's name and address, as well as the contact person's name and phone number. Provide your social security number or employer identification number.

- Fill in the taxpayer's information including their name, address, social security number, and any other required identification details.

- Indicate when the employer will forward payments to the IRS by checking the appropriate box for weekly, bi-weekly, or monthly payments.

- Specify the amount to be deducted from each wage or salary payment. Include the date from which the deduction will begin and any details regarding increases or decreases in the deduction amount.

- Review the terms of the agreement and ensure all information is accurately filled out. Sign the form, and if applicable, have the spouse countersign.

- Once completed, save your changes, download or print the form for records, and then share or submit the form to the IRS as instructed.

Complete your IRS 2159 form online now to manage your tax payments effectively.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To fill out a tax payment check, include the correct payee, which is the 'United States Treasury.' In the comments section, write your Social Security number and the tax year. Make sure you don’t leave any sections blank, as this could lead to processing delays. Properly completed checks can support your payment plan set through IRS 2159.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.