Loading

Get Irs 2159 2016

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 2159 online

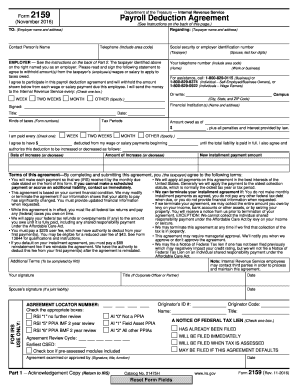

The IRS 2159 form, also known as the Payroll Deduction Agreement, allows taxpayers to set up a payroll deduction to pay off their tax liabilities. This guide provides step-by-step instructions to assist users in successfully completing the form online.

Follow the steps to fill out the IRS 2159 effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the 'Regarding' section with your name and address, followed by your employer's name and address in the 'TO' section.

- Provide the contact person's name and your social security number or employer identification number, ensuring that you include the area code for your telephone number.

- Review the statement regarding the employer’s agreement to withhold amounts from your wages. The employer must sign to confirm participation.

- Select how often the payments will be sent to the IRS by checking the appropriate box for WEEK, TWO WEEKS, or MONTH.

- Indicate the amount owed and the starting date for the wage deductions on the form.

- If adjustments to the amount deducted are required, provide the necessary details for increases or decreases, including the new installment amount.

- Review the terms of the agreement carefully. After understanding your obligations, provide your signature and date the form.

- Give the signed form to your participating employer, who must complete their section and return the form to the IRS.

- Once completed, you can save your changes or download the form for your records before submitting it.

Complete your IRS 2159 form online today to ensure timely compliance with your tax obligations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To fill out a W-2 wage and Tax Statement, you'll need to gather necessary information, including names, Social Security numbers, and earnings. Complete the form with your employer's information and ensure the wages match your records, such as your IRS 2159. Remember to follow IRS guidelines and consider using the US Legal Forms platform for assistance in filling out this important document.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.