Loading

Get Irs 14310 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 14310 online

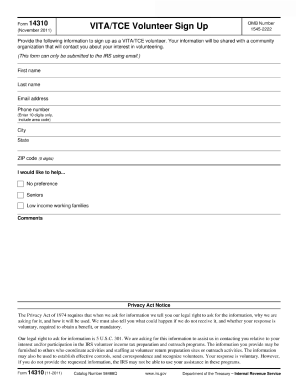

The IRS 14310 form is essential for individuals interested in volunteering with the VITA/TCE programs. This guide provides straightforward instructions to help users fill out the form accurately and efficiently online.

Follow the steps to complete the IRS 14310 form online.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Enter your first name in the designated field to identify yourself.

- Fill in your last name to complete your identification process.

- Provide your email address, ensuring it is correct for communication purposes.

- Input your 10-digit phone number, including the area code, to facilitate contact.

- Specify your city of residence to aid in volunteer placement.

- Select your state from the dropdown list to provide your location.

- Indicate if you are interested in obtaining continuing education (CE) credits for your volunteer work.

- Answer whether you are an IRS employee interested in VITA/TCE opportunities. A current PTIN is required if you answer 'Yes.'

- Fill in your ZIP code using the 5 digits to complete your address information.

- Add any comments that may support your application or volunteer interests.

- Review your entries for accuracy and completeness before final submission.

- Email the completed form to TaxVolunteer@IRS.gov to submit your application.

Start filling out your IRS 14310 form online today to make a difference as a VITA/TCE volunteer.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

A qualified first time home buyer, as defined by the IRS, is someone who has not owned a home in the last three years and meets other specific criteria. Such buyers can enjoy various tax benefits and programs aimed at facilitating home ownership. By using IRS 14310, you can gather all necessary information to confirm your status and explore available benefits.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.