Get Irs 14157 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 14157 online

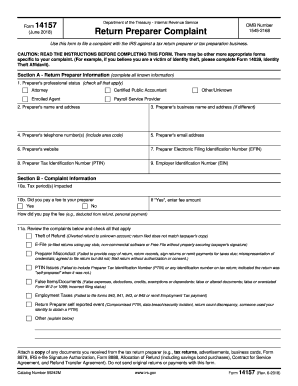

Filing a complaint against a tax return preparer is an important step for protecting your financial interests. The IRS 14157 form allows users to report misconduct or issues related to tax preparation services. This guide will walk you through each section of the form to ensure you have a comprehensive understanding of how to complete it online.

Follow the steps to successfully complete your IRS 14157 form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Section A, provide all known information about the return preparer. Check all professional status options applicable to the preparer, such as attorney or certified public accountant, and fill in their name and contact details.

- In Section B, clearly describe the issues prompting your complaint. Indicate the affected tax period and check any applicable allegations such as theft of refund or e-file misconduct.

- If applicable, attach any relevant documents, such as tax returns or contracts, to support your claims. Be sure to include details requested in the form about the complaint.

- Proceed to Section C, answering whether you are the taxpayer. If you are the taxpayer, complete only this section. If not, fill in both Sections C and D to provide your contact information.

- In Section D, if you are not the taxpayer, provide your relationship to the preparer and your contact information to facilitate communication.

- Review all entered information for accuracy before finalizing. You can then save your changes, download, print, or share the form as needed.

Complete your IRS 14157 complaint online today to address any issues with your tax preparer.

Related links form

IRS Form 14157 is used to report suspected misconduct by your tax preparer. If you believe your accountant has committed fraud, negligence, or any unethical behavior, you can use this form to formally report them. Understanding how IRS 14157 functions will empower you to protect your financial interests. Using platforms like US Legal Forms can assist you in correctly filling out and submitting this form.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.