Loading

Get Paycheck Stub

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Paycheck Stub online

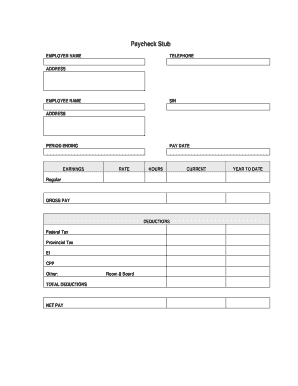

Completing a paycheck stub online can be a straightforward process when you understand its components. This guide will walk you through each section of the form so that you can fill it out accurately and efficiently.

Follow the steps to complete your paycheck stub online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin by entering your employer's name, telephone number, and address in the designated fields. Ensure that this information is accurate, as it identifies who is issuing the paycheck.

- Next, fill in your name, social insurance number (SIN), and your address. This personal information ensures the paycheck is correctly attributed to you.

- Locate the 'Period Ending' field, and input the date that corresponds to the end of the pay period for which you are being paid.

- In the 'Earnings' section, enter the pay date and rate of pay you received during this period. Specify the number of hours you worked and categorize them as regular hours.

- Calculate and fill in your gross pay, which is your total earnings before any deductions are taken out.

- Proceed to the 'Deductions' section. Input the amounts for federal tax, provincial tax, employment insurance (EI), Canada Pension Plan (CPP), and any other deductions that apply.

- If applicable, include any deductions related to room and board. Calculate the total deductions and enter this amount in the corresponding field.

- Finally, calculate your net pay by deducting the total deductions from your gross pay and enter this figure in the designated field.

- Once you have completed all sections, review your entries for accuracy. You can then choose to save changes, download, print, or share the form.

Complete your paycheck stub online today for precise and hassle-free documentation.

Yes, you can create your own paystub using online tools designed for this purpose. Our platform offers customizable templates that allow you to input your specific earnings and deductions. This way, you can have a professional-looking paycheck stub whenever you need it. Making your own paystub ensures you have control over your financial records.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.