Get Irs 13615 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 13615 online

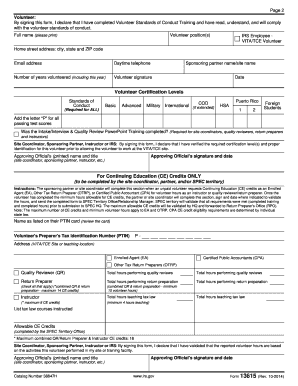

The IRS 13615 form is a crucial document for individuals involved in the Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs. This guide provides a comprehensive step-by-step approach to filling out the form online, ensuring volunteers understand their responsibilities and can successfully complete the process.

Follow the steps to fill out the IRS 13615 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your full name as it appears on official records. This step ensures that your identity is accurately represented.

- Indicate your volunteer position. Options include IRS Employee, VITA/TCE Volunteer, or other relevant roles.

- Provide your home address, including street, city, state, and ZIP code. Accurate contact information is essential for communication.

- Enter your email address to facilitate digital correspondence and updates regarding your volunteering.

- Include your daytime telephone number so that you can be contacted if needed.

- List the name of the sponsoring partner or site name where you will be volunteering.

- Specify the number of years you have volunteered, including the current year, to highlight your experience.

- Sign and date the form to confirm that you have completed the Volunteer Standards of Conduct Training and agree to the standards laid out.

- Ensure that the approving official from your VITA/TCE site reviews your form, enters their signature and date, and adds their printed name and title.

- If applicable, the site coordinator or sponsor should complete the Continuing Education (CE) Credits section, documenting any credit hours requested.

- Finally, save your changes, then download, print, or share the completed form as needed for submission.

Start filling out the IRS 13615 online today to ensure your participation in the VITA/TCE programs!

Get form

The IRS data retrieval tool was initially suspended due to security concerns but has since been reintroduced with enhanced security features. This tool now offers a more secure method for accessing your tax information. Users can expect improved functionality and a smoother experience compared to previous versions. Always check the latest updates to ensure you can utilize this valuable resource effectively.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.