Loading

Get Irs 1125-e 2012

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1125-E online

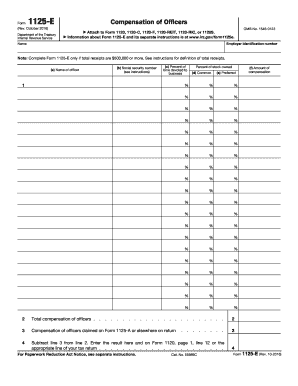

The IRS Form 1125-E is used to report the compensation of officers for certain corporations. This guide provides detailed, step-by-step instructions on how to accurately complete the form online, ensuring you meet the necessary requirements.

Follow the steps to complete the IRS 1125-E form online.

- Click the ‘Get Form’ button to download the form and open it in your preferred online editor.

- Enter your employer identification number (EIN) in the designated field at the top of the form, as it identifies your business for tax purposes.

- Provide the name of your corporation in the appropriate section, ensuring accuracy for your records.

- Complete the officer information table by entering each officer's name, social security number, percent of time they devote to the business, and the percentage of common and preferred stock owned.

- In the 'Amount of compensation' column, detail each officer's compensation for the year. This is crucial for accurate reporting.

- After entering all data for each officer, calculate the total compensation in the designated field to provide a comprehensive overview.

- Report any compensation of officers that is claimed on Form 1125-A or elsewhere on your tax return, ensuring duplication is avoided.

- Subtract the amount reported in line 3 from line 2. This final calculation will give you the total compensation that should be reported on your main tax return.

- Review all entered information for accuracy and completeness and ensure it aligns with your business records before proceeding.

- Once completed, save your changes, then download, print, or share the form as needed for submission.

Ensure your filing is accurate—fill out the IRS 1125-E online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To abate an IRS civil penalty, you must file a request with the IRS demonstrating reasonable cause for your failure to comply. Clear documentation and a thoughtful explanation can strengthen your case. Engaging with services like uslegalforms can offer guidance throughout this process, simplifying your experience.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.