Loading

Get Irs 1120s - Schedule M-3 2013

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1120S - Schedule M-3 online

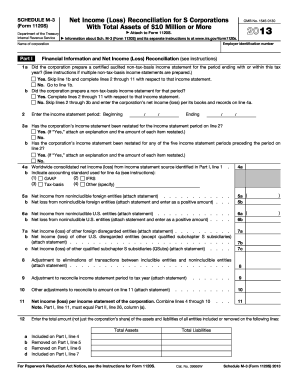

Filling out the IRS 1120S - Schedule M-3 is crucial for S corporations with total assets of $10 million or more. This guide provides a step-by-step approach to ensure accurate and efficient completion of the form online.

Follow the steps to successfully complete Schedule M-3.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the employer identification number and the corporation's name in the designated fields at the top of the form.

- In Part I, indicate if the corporation prepared a certified audited non-tax-basis income statement for the period by selecting 'Yes' or 'No.' If 'Yes,' complete lines 2 through 11 based on that statement; if 'No,' move to line 1b.

- For line 1b, if the corporation did not prepare a non-tax-basis income statement, enter the corporation’s net income or loss per its books and records on line 4a.

- Complete the income statement period in the format provided on line 2, specifying the beginning and ending dates.

- Respond to questions regarding whether the income statement has been restated for the current or any of the previous five periods. If applicable, attach explanations as necessary.

- Report the worldwide consolidated net income or loss from the identified income statement source on line 4a and select the applicable accounting standards used for this line.

- Proceed to report net income and net losses as instructed for foreign and U.S. entities on lines 5 through 7, attaching statements where required.

- Complete any adjustments necessary to reconcile the income statement period to the tax year as directed in subsequent lines, attaching statements for clarity.

- In Part II, reconcile the net income or loss per income statement with the total income or loss per return, filling in the necessary columns for temporary and permanent differences.

- Move to Part III to detail expense and deduction items, ensuring that you categorize them correctly and attach additional statements as needed.

- Once all sections have been completed accurately, save your changes and prepare to download, print, or share the form as required.

Start filling out your IRS 1120S - Schedule M-3 online today to ensure compliance and accuracy!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Filing IRS 1120S can be streamlined by using tax software or hiring a tax professional familiar with corporate taxes. You can file electronically or via mail, but electronic filing usually speeds up processing and reduces errors. Consider using US Legal Forms for reliable templates and guidance throughout the filing process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.