Get Ak 0405-6300i 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign AK 0405-6300i online

How to fill out and sign AK 0405-6300i online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When the fiscal period started unexpectedly or perhaps you simply overlooked it, it may likely cause issues for you.

AK 0405-6300i is not the simplest one, but there’s no need for concern in any situation.

With our robust digital solution and its professional tools, completing AK 0405-6300i becomes more manageable. Don’t hesitate to utilize it and enjoy more leisure time instead of preparing documents.

- Access the document using our expert PDF editor.

- Complete all required details in AK 0405-6300i, utilizing the fillable fields.

- Include images, ticks, checkboxes, and text boxes, if necessary.

- Repeated information will be entered automatically after the initial input.

- If you encounter any challenges, utilize the Wizard Tool. You’ll see some suggestions for much easier completion.

- Remember to include the date of submission.

- Create your personalized signature once and place it in all the required areas.

- Review the information you have entered. Amend any errors if needed.

- Click Done to complete editing and choose your delivery method. You will have the option to use virtual fax, USPS or email.

- You can download the file to print it later or upload it to cloud storage such as Dropbox, OneDrive, etc.

How to modify Get AK 0405-6300i 2016: personalize forms online

Place the appropriate document management resources at your disposal. Complete Get AK 0405-6300i 2016 with our dependable tool that features editing and eSignature capabilities.

If you desire to process and authenticate Get AK 0405-6300i 2016 online seamlessly, then our web-based solution is the perfect choice. We provide an extensive template-driven catalog of ready-to-use forms that you can adjust and complete online. Additionally, there is no need to print the document or resort to external solutions to make it fillable. All the essential tools will be conveniently accessible as soon as you open the file in the editor.

Let’s explore our online editing functionalities and their primary features. The editor offers an intuitive interface, so it won’t take much time to learn how to navigate it. We’ll review three key sections that enable you to:

In addition to the functionalities mentioned previously, you can protect your file with a password, incorporate a watermark, convert the file to the required format, and much more.

Our editor simplifies modifying and certifying the Get AK 0405-6300i 2016. It empowers you to manage essentially everything involving document handling. Furthermore, we consistently guarantee that your experience with files remains secure and adheres to the primary regulatory standards. All these aspects enhance the pleasure of using our solution.

Obtain Get AK 0405-6300i 2016, make the required modifications and adjustments, and receive it in your preferred file format. Give it a try today!

- Alter and annotate the template

- The upper toolbar contains the tools that allow you to emphasize and obscure text, without images and visual elements (lines, arrows, and checkmarks, etc.), sign, initialize, date the document, and more.

- Arrange your documents

- Utilize the left toolbar if you wish to rearrange the document or/and eliminate pages.

- Make them distributable

- If you want to render the document fillable for others and share it, you can apply the tools on the right and insert various fillable fields, signatures, dates, text boxes, etc.

Get form

Related links form

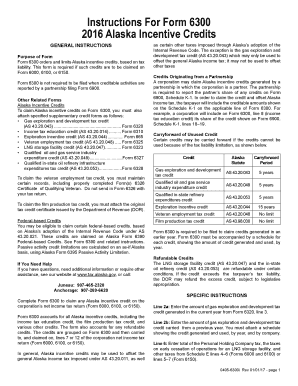

To fill out a tax amendment form, such as the 1040-X, start by gathering your original return and necessary documentation. Identify the changes that need to be made and clearly explain each adjustment on the form. The AK 0405-6300i can be a valuable resource to help you navigate through the amendments accurately and efficiently. Ensure that all changes are well-documented to avoid any confusion.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.