Loading

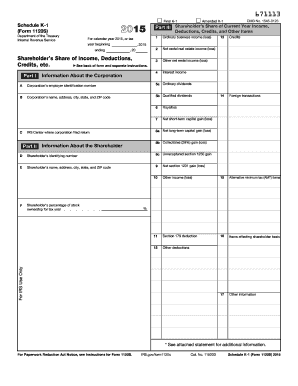

Get Irs 1120s - Schedule K-1 2015

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1120S - Schedule K-1 online

Filling out the IRS 1120S - Schedule K-1 form can be a straightforward process when you follow the right steps. This guide aims to walk you through the various sections and fields of the form, ensuring you complete it accurately and efficiently.

Follow the steps to complete the IRS 1120S - Schedule K-1 online.

- Click ‘Get Form’ button to access the form and open it in your preferred editor.

- In Part I, enter the corporation’s name, address, and employer identification number in the designated fields. This section provides essential information about the corporation.

- Move to Part II, where you will select whether this is an amended or final K-1. Pay attention to any instructions related to this section.

- In Part III, fill in your share of the corporation’s current year income, deductions, credits, and other items. Begin with ordinary business income (loss) and follow through to other income categories like interest income, dividends, royalties, and any gains or losses on investments.

- For each item listed, ensure that you report correctly based on whether the income is passive or nonpassive. Follow the guidelines for reporting on the correct schedules.

- Complete any additional information necessary, such as foreign transactions and alternative minimum tax items, if applicable.

- Finally, review all entries for accuracy, then save your changes, download, print, or share the completed form as needed.

Begin completing your IRS 1120S - Schedule K-1 online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

1 distributions do not count as taxable income at the moment of distribution; they instead reduce your stock basis in the S Corporation. When distributions exceed your basis, however, they may be subject to taxes as capital gains. Understanding how these distributions affect your overall tax situation is crucial, and platforms like US Legal Forms can provide helpful resources to aid in managing your tax complexities.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.