Loading

Get Irs 1120-w 2015

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1120-W online

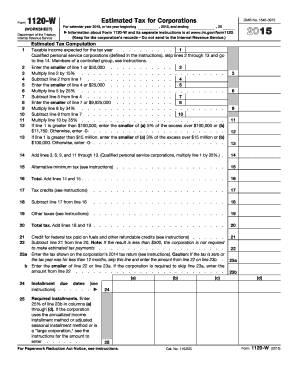

Filling out the IRS 1120-W is essential for corporations to estimate their tax liability for the upcoming tax year. This guide provides a comprehensive and user-friendly approach to completing the form online, ensuring accuracy and compliance.

Follow the steps to complete the IRS 1120-W online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- In the first section, enter your expected taxable income for the tax year on line 1. Qualified personal service corporations can skip to line 14.

- On line 2, enter the smaller amount between line 1 or $50,000 to compute your initial tax.

- Calculate 15% of line 2 and enter the result on line 3.

- Subtract line 2 from line 1 and write the result on line 4.

- From line 4, find the smaller number between line 4 or $25,000 and write it on line 5. Then, calculate 25% of line 5 and record it on line 6.

- Continue this process with the subsequent lines, completing all tax calculations as specified until you reach line 14. In line 14, add the results from lines 3, 6, 9, and 11 through 13.

- Complete lines for alternative minimum tax, tax credits, and other taxes as needed, until reaching the total tax on line 20.

- Finally, ensure to save your changes, and you can download, print, or share the completed form.

Complete your IRS 1120-W online now to ensure timely and accurate submission.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Form 1120-W continues to be an important IRS form for corporations needing to make estimated tax payments. There have been no announcements regarding its discontinuation, which means businesses should keep using this form to calculate their taxes accurately. Staying compliant with the IRS 1120-W will help ensure you meet your federal tax requirements.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.