Loading

Get Irs 990 - Schedule R 2019

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 990 - Schedule R online

This guide provides a clear and supportive approach for users looking to complete the IRS 990 - Schedule R online. Understanding the components and requirements of the form will lead to a more efficient and accurate filing process.

Follow the steps to successfully complete the IRS 990 - Schedule R.

- Press the ‘Get Form’ button to access the IRS 990 - Schedule R online form and open it in your preferred editor.

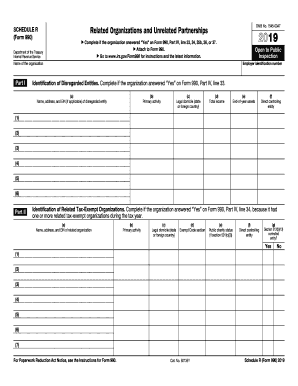

- Begin with Part I, which involves identification of disregarded entities. Enter the name, address, and employer identification number (EIN) of each disregarded entity, along with its primary activities, legal domicile, total income, end-of-year assets, and direct controlling entity.

- Move to Part II to identify related tax-exempt organizations. Record the relevant information for related organizations, including their name, address, EIN, primary activities, legal domicile, exempt code section, public charity status, direct controlling entity, and whether they are section 512(b)(13) controlled entities.

- In Part III, provide details about related organizations that are taxable as partnerships. Fill in the name, address, EIN, primary activity, legal domicile, direct controlling entity, predominant income, share of total income, share of end-of-year assets, code V amount, and percentage ownership.

- Proceed to Part IV, which focuses on related organizations treated as corporations or trusts. Supply the necessary information similar to Part III, ensuring to indicate the type of entity and relevant financial details.

- For Part V, detail any transactions with related organizations expressed in the previous sections. Indicate the nature of each transaction, the amount involved, and how you determined that amount.

- If applicable, complete Part VI regarding unrelated organizations taxable as partnerships. Provide the name, address, EIN, primary activity, legal domicile, income details, and ownership information.

- Lastly, fill out Part VII with any supplemental information that may enhance your responses to earlier questions. This can help clarify any complex relationships or transactions.

- Once all sections are complete, review your entries carefully. Finally, you can choose to save changes, download a copy, print it, or share the form as needed.

Ensure your IRS 990 - Schedule R is accurate and complete by filling it out online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Reportable compensation encompasses all forms of income provided to employees, including wages, bonuses, and other financial rewards. This definition is important in the context of IRS 990 - Schedule R to ensure full accountability. Organizations that clearly report this compensation contribute to enhanced integrity and public trust.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.