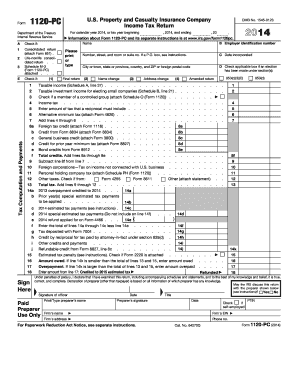

Get Irs 1120-pc 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1120-PC online

Filling out the IRS 1120-PC form online is essential for U.S. property and casualty insurance companies to report their income tax. This guide provides a clear, step-by-step approach to completing the form accurately, ensuring users, regardless of their prior experience, can navigate the process with ease.

Follow the steps to complete the IRS 1120-PC online.

- Click ‘Get Form’ button to obtain the IRS 1120-PC form and access it in your online document editor.

- Provide the corporation's name and employer identification number (EIN) in the designated fields.

- Indicate the date of incorporation and the relevant tax year at the top of the form.

- Complete Section A, noting if this is a final return, and check any applicable boxes for elections made under specific sections.

- Enter taxable income as outlined in Schedule A and any other relevant income or deductions in their respective sections.

- For tax credits, include any applicable amounts from Forms 1118, 8834, or 3800, ensuring you that each credit is properly attached.

- Continue filling out Schedule B for taxable investment income, providing detailed entries for interest, dividends, and other relevant earnings.

- Complete additional schedules as required, including Schedule C for dividends, Schedule E for premiums earned, and Schedule F for losses incurred.

- At the end of the form, review all fields for accuracy and completeness. Save your work.

- Once reviewed, download, print or share the completed form as necessary. Make sure to keep a copy for your records.

Start completing your IRS 1120-PC form online today to ensure timely and accurate submission.

Get form

Related links form

IRS Form 1120-PC is specifically designed for domestic insurance companies operating under specific regulations. Businesses that meet these criteria are required to file this form annually. Ensure that your organization falls within these parameters to avoid any potential issues. If you are unsure, consider consulting resources like US Legal Forms for clarity on filing requirements.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.