Get Irs 1120-f - Schedule M-1 & M-2 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1120-F - Schedule M-1 & M-2 online

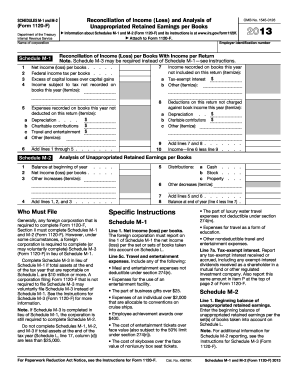

The IRS 1120-F - Schedule M-1 & M-2 provides a framework for foreign corporations to reconcile their income and analyze retained earnings. This guide will walk you through the process of completing these schedules online, ensuring clarity and accuracy in your filing.

Follow the steps to successfully complete Schedules M-1 and M-2 online.

- Click ‘Get Form’ button to acquire the form and open it in your chosen online editor.

- Begin by completing Schedule M-1. Report the net income (loss) per books on line 1, based on the financial records for the year. Ensure all figures correspond with the accounting books maintained.

- On line 7a of Schedule M-1, disclose any tax-exempt interest that has been accrued or received, including applicable dividends from mutual funds. This amount should also be recorded at the top of Form 1120-F.

- For line 5 on Schedule M-1, detail any expenses recorded that were not deducted from the return. This includes specific categories such as depreciation and charitable contributions. Itemize each expense accurately.

- Continue to Schedule M-2 by entering the beginning balance of unappropriated retained earnings on line 1. This should be in line with the financial records noted on Schedule L.

- On Schedule M-2, report any increases to retained earnings, including net income or other increases on respective lines within the schedule.

- After filling out both schedules, review all entries for accuracy. Once verified, you can save changes, download, print, or share the completed forms.

Complete your IRS 1120-F - Schedule M-1 & M-2 online today for seamless tax filing.

Get form

Related links form

Schedule M is used to reconcile book income with taxable income for various tax forms, including IRS 1120-F. This schedule helps identify the differences and adjustments needed to comply with IRS standards. Proper completion of Schedule M ensures accurate reporting and can lead to a smoother audit process if necessary. Furthermore, utilizing tools like the uslegalforms platform can simplify this reconciliation for you.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.