Get Irs 1120 - Schedule G 2011-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1120 - Schedule G online

How to fill out and sign IRS 1120 - Schedule G online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When individuals aren’t linked with document management and legal procedures, completing IRS forms can be quite stressful.

We understand the importance of accurately completing paperwork.

Using our online tool will enable professional completion of IRS 1120 - Schedule G. Make everything for your ease and straightforward work.

- Select the button Get Form to access it and begin editing.

- Complete all required fields in the document using our professional PDF editor. Activate the Wizard Tool to simplify the process even further.

- Verify the accuracy of the entered information.

- Include the date of submission for IRS 1120 - Schedule G. Use the Sign Tool to create a personal signature for document validation.

- Conclude editing by clicking Done.

- Submit this document directly to the IRS in the most convenient way for you: via email, digital fax, or postal service.

- You have the option to print it on paper if a hard copy is needed and download or store it in your preferred cloud storage.

How to Revise Get IRS 1120 - Schedule G 2011: Personalize Forms Online

Your swiftly editable and customizable Get IRS 1120 - Schedule G 2011 template is readily accessible. Maximize our collection with an integrated online editor.

Do you delay finalizing Get IRS 1120 - Schedule G 2011 because you are unsure where to begin and how to proceed? We recognize your concerns and have an excellent resource for you that has nothing to do with tackling your procrastination!

Our online assortment of ready-to-use templates allows you to filter through and choose from numerous fillable forms tailored for various objectives and situations. But acquiring the document is just the beginning. We provide you with all the essential tools to complete, certify, and modify the form of your choice without leaving our site.

All you have to do is open the form in the editor. Review the wording of Get IRS 1120 - Schedule G 2011 and verify if it's what you’re looking for. Start altering the template by utilizing the annotation features to give your form a more structured and tidier appearance.

In conclusion, along with Get IRS 1120 - Schedule G 2011, you'll receive:

Adherence to eSignature regulations governing the utilization of eSignature in electronic transactions.

With our professional service, your completed forms will always be officially enforceable and fully encrypted. We guarantee to protect your most sensitive information.

- Insert checkmarks, circles, arrows, and lines.

- Highlight, redact, and revise the existing text.

- If the form is designed for others as well, you can integrate fillable fields and distribute them for others to complete.

- Once you finish altering the template, you can obtain the document in any available format or choose any sharing or delivery options.

- A robust suite of editing and annotation tools.

- An integrated legally-binding eSignature solution.

- The capability to create forms from scratch or based on the pre-prepared template.

- Compatibility with various platforms and devices for enhanced convenience.

- Numerous options for securing your documents.

- A wide variety of delivery methods for easier sharing and distribution of documents.

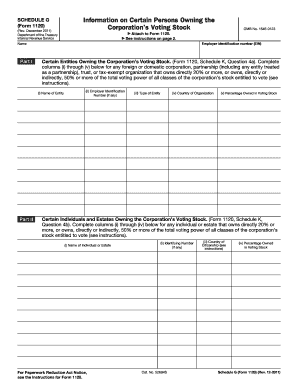

The Schedule 1120 tax form is a comprehensive report that corporations must file to document their income, deductions, and tax liabilities. It serves as the primary vehicle for corporations to report financial activity to the IRS. Understanding IRS 1120 - Schedule G is crucial for accurately reflecting any distributions and ownership changes that occur within the corporation.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.