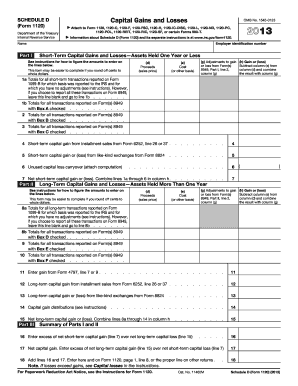

Get Irs 1120 - Schedule D 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1120 - Schedule D online

How to fill out and sign IRS 1120 - Schedule D online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When you aren't connected with document handling and legal procedures, completing IRS documents can be unexpectedly challenging.

We understand the importance of accurately filling out forms.

Utilizing our robust solution will enable professional completion of IRS 1120 - Schedule D. We will ensure everything is set up for your comfortable and secure experience.

- Select the button Get Form to access it and begin editing.

- Enter all required information in the document using our helpful PDF editor. Activate the Wizard Tool to simplify the process even further.

- Verify the accuracy of the provided information.

- Add the submission date for IRS 1120 - Schedule D. Use the Sign Tool to create a unique signature for document validation.

- Finish editing by clicking Done.

- Send this document directly to the IRS in the most convenient manner for you: via email, utilizing virtual fax, or traditional mail.

- You can print it out when a hard copy is necessary and download or store it in your preferred cloud storage.

How to Modify Get IRS 1120 - Schedule D 2013: Personalize documents online

Utilize our comprehensive online document editor while preparing your forms. Complete the Get IRS 1120 - Schedule D 2013, highlight the most important details, and easily make any other necessary modifications to its content.

Filling documents digitally is not only efficient but also provides the option to adjust the template according to your requirements. If you’re about to work on Get IRS 1120 - Schedule D 2013, consider completing it with our comprehensive online editing tools. Whether you make a mistake or enter the required information into the incorrect field, you can effortlessly alter the form without needing to restart it from scratch as you would during manual completion. Furthermore, you can emphasize the key information in your document by highlighting specific pieces of content with colors, underlining, or circling them.

Follow these quick and easy steps to complete and edit your Get IRS 1120 - Schedule D 2013 online:

Our powerful online solutions are the most effective method to fill out and modify Get IRS 1120 - Schedule D 2013 based on your requirements. Use it to manage personal or professional documents from anywhere. Access it in a browser, make any changes to your forms, and return to them anytime in the future - all will be securely stored in the cloud.

- Access the file in the editor.

- Input the required information in the blank fields using Text, Check, and Cross tools.

- Navigate through the form to ensure no essential areas are overlooked.

- Circle some of the crucial details and add a URL to it if needed.

- Utilize the Highlight or Line options to emphasize the most important pieces of content.

- Select colors and thickness for these lines to make your document appear professional.

- Erase or blackout the information you wish to keep hidden.

- Replace portions of content that contain mistakes and input the text you require.

- Conclude editing with the Done button once you are sure everything is accurate in the form.

Get form

Related links form

To enter the IRS 1120 - Schedule D in TurboTax, navigate to the section for investment income and proceed to input your capital gains and losses. The software will guide you through entering the necessary information from your investment records. Utilizing TurboTax streamlines the process and helps ensure that your Schedule D is completed accurately.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.