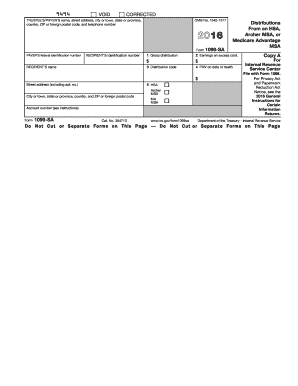

Get Irs 1099-sa 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1099-SA online

How to fill out and sign IRS 1099-SA online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When individuals aren’t linked with document handling and legal processes, filling out IRS documents can be very stressful. We recognize the importance of accurately completing forms.

Our platform provides the answer to simplify the process of filling out IRS documents as efficiently as possible. Follow these suggestions to swiftly and correctly submit IRS 1099-SA.

Utilizing our platform can undeniably make professional filling of IRS 1099-SA achievable. We will do everything to ensure your work is comfortable and straightforward.

- Click on the button Get Form to access it and start editing.

- Complete all necessary fields in the chosen document using our helpful PDF editor. Activate the Wizard Tool to make the process much simpler.

- Verify the accuracy of the entered information.

- Include the date of completing IRS 1099-SA. Use the Sign Tool to create a unique signature for document validation.

- Finish editing by selecting Done.

- Send this document to the IRS in the most convenient manner for you: via email, using virtual fax, or postal mail.

- You can print it on paper if a physical copy is needed and download or save it to your preferred cloud storage.

How to revise Get IRS 1099-SA 2016: personalize forms online

Place the appropriate document modification tools at your disposal. Complete Get IRS 1099-SA 2016 with our dependable solution that includes editing and eSignature features.

If you wish to execute and validate Get IRS 1099-SA 2016 online effortlessly, then our web-based solution is the perfect choice. We provide a rich library of template-based forms that you can customize and fill out online. Furthermore, there’s no need to print the form or rely on external services to make it fillable. All essential features will be accessible once you open the file in the editor.

Let’s explore our online editing functionalities and their primary features. The editor presents a user-friendly interface, ensuring you won’t need much time to learn how to use it. We will review three key components that allow you to:

In addition to the previously mentioned capabilities, you can secure your file with a password, include a watermark, convert the document to the required format, and much more.

Our editor simplifies the process of completing and certifying the Get IRS 1099-SA 2016. It empowers you to handle nearly every aspect of form management. Moreover, we consistently ensure that your document interaction is secure and adheres to the primary regulatory standards. All these elements contribute to a more satisfying user experience.

Obtain Get IRS 1099-SA 2016, make the necessary adjustments and alterations, and receive it in your preferred file format. Give it a try today!

- Alter and comment on the template

- The top toolbar incorporates features that assist you in highlighting and obscuring text, without graphic elements (lines, arrows, checkmarks, etc.), signing, initialing, dating the form, and more.

- Organize your documents

- Utilize the toolbar on the left if you want to rearrange the form or delete pages.

- Prepare them for distribution

- If you intend to make the document fillable for others and share it, various tools on the right allow you to insert different fillable fields, signatures, and dates, text boxes, etc.

Get form

Related links form

Form 5498 is not the same as 1099-SA. The 5498 form focuses on reporting contributions to Health Savings Accounts, while the IRS 1099-SA covers distributions made from those accounts. Knowing the difference between these forms is essential for effective financial management. This understanding helps avoid confusion during tax preparation.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.