Get Irs W-8ben 2000

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS W-8BEN online

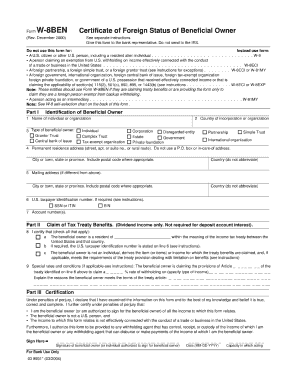

The IRS W-8BEN form is essential for individuals who are non-U.S. persons to certify their foreign status and claim a reduced withholding tax rate. This guide provides step-by-step instructions to help you navigate the process of completing the form online efficiently.

Follow the steps to complete the IRS W-8BEN form with ease.

- Press the ‘Get Form’ button to access the IRS W-8BEN form and open it for editing.

- In Part I, provide your name as the individual who is the beneficial owner. Make sure to write it exactly as it appears on your legal documents.

- Enter your country of citizenship in Part I, ensuring that it accurately reflects your citizenship status.

- In Part II, if applicable, provide your foreign tax identifying number. This is necessary for claiming benefits under your country's tax treaty with the United States.

- Complete question 8 in Part II if you have a U.S. taxpayer identification number. If you do not have one, leave this section blank.

- If claiming tax benefits under an income tax treaty, fill out Part III, including the name of the country and the appropriate article number from the treaty.

- In Part IV, sign and date the form. Confirm that the information provided is complete and accurate to the best of your knowledge.

- Once you've filled out the form completely, you can save your changes, download a copy for your records, or print it as needed.

Complete your IRS W-8BEN form online today to ensure accurate and efficient processing.

Get form

The W8BEN E form is employed by foreign entities to establish their foreign status and claim benefits on U.S. income. This form allows businesses to avoid excessive tax withholding similar to individual users of the W-8BEN. By accurately completing the W8BEN E form, entities can benefit from reduced tax rates in accordance with tax treaties. Understanding this form is essential for any foreign business engaged in U.S. operations.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.