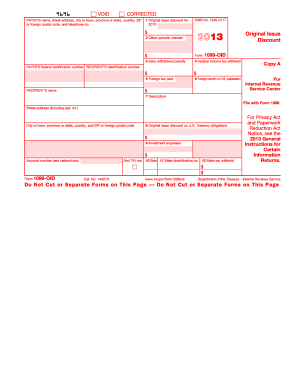

Get Irs 1099-oid 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1099-OID online

How to fill out and sign IRS 1099-OID online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

If you aren’t linked to paperwork administration and legal activities, submitting IRS forms will be exceedingly challenging. We recognize the significance of accurately completing documents.

Our service offers the solution to simplify the process of filing IRS documents as effortlessly as possible. Adhere to these instructions to swiftly and precisely submit IRS 1099-OID.

Using our platform will turn professional filling of IRS 1099-OID into reality. Ensure everything for your comfortable and secure operation.

- Choose the button Get Form to access it and begin editing.

- Complete all necessary fields in the chosen file using our robust and user-friendly PDF editor. Activate the Wizard Tool to streamline the process even more.

- Verify the accuracy of the filled-in information.

- Input the date of completion for IRS 1099-OID. Utilize the Sign Tool to create a personal signature for the document's validation.

- Finish editing by selecting Done.

- Transmit this document to the IRS in the most convenient manner for you: via email, using online fax, or postal service.

- You can print it for a physical copy when required and download or save it to your preferred cloud storage.

How to alter Get IRS 1099-OID 2013: personalize forms online

Place the appropriate document modifying tools within your reach. Perform Get IRS 1099-OID 2013 with our reliable tool that includes editing and eSignature capabilities.

If you desire to finalize and authenticate Get IRS 1099-OID 2013 online effortlessly, then our web-based solution is the perfect choice. We offer an extensive template-based collection of ready-to-use forms you can adapt and complete online. Additionally, you won't need to print the document or rely on external solutions to make it fillable. All necessary features will be instantly accessible for your utilization once you launch the document in the editor.

Let’s explore our web editing tools and their primary functionalities. The editor has a user-friendly interface, so it won't take much time to master how to operate it. We’ll examine three main areas that enable you to:

Besides the features outlined above, you can secure your document with a password, add a watermark, convert the file to the necessary format, and much more.

Our editor makes altering and authenticating the Get IRS 1099-OID 2013 effortless. It allows you to do nearly everything related to document management. Furthermore, we always guarantee that your experience working with files is safe and compliant with the primary regulatory standards. All these aspects make utilizing our tool even more enjoyable.

Obtain Get IRS 1099-OID 2013, implement the required modifications and adjustments, and receive it in the preferred file format. Try it out today!

- Alter and comment on the template

- The upper toolbar provides features to emphasize and block out text, without images and visual elements (lines, arrows, checkmarks, etc.), sign, initial, date the document, and more.

- Arrange your documents

- Utilize the left-side toolbar if you want to reorganize the document or/and eliminate pages.

- Make them distributable

- If you wish to make the document fillable for others and share it, you can employ the tools on the right and insert different fillable fields, signature and date, text box, etc.

Get form

Related links form

You typically report a 1099 on your tax return under the income section. Whether it is for interest income or other types of earnings, clarity is crucial. Platforms like US Legal Forms can assist in ensuring you accurately categorize your 1099 income, which is essential for a successful tax filing.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.